Do I Pay Tax On Gifts From Family Overseas?

If I receive gifts from overseas, what taxes am liable for?

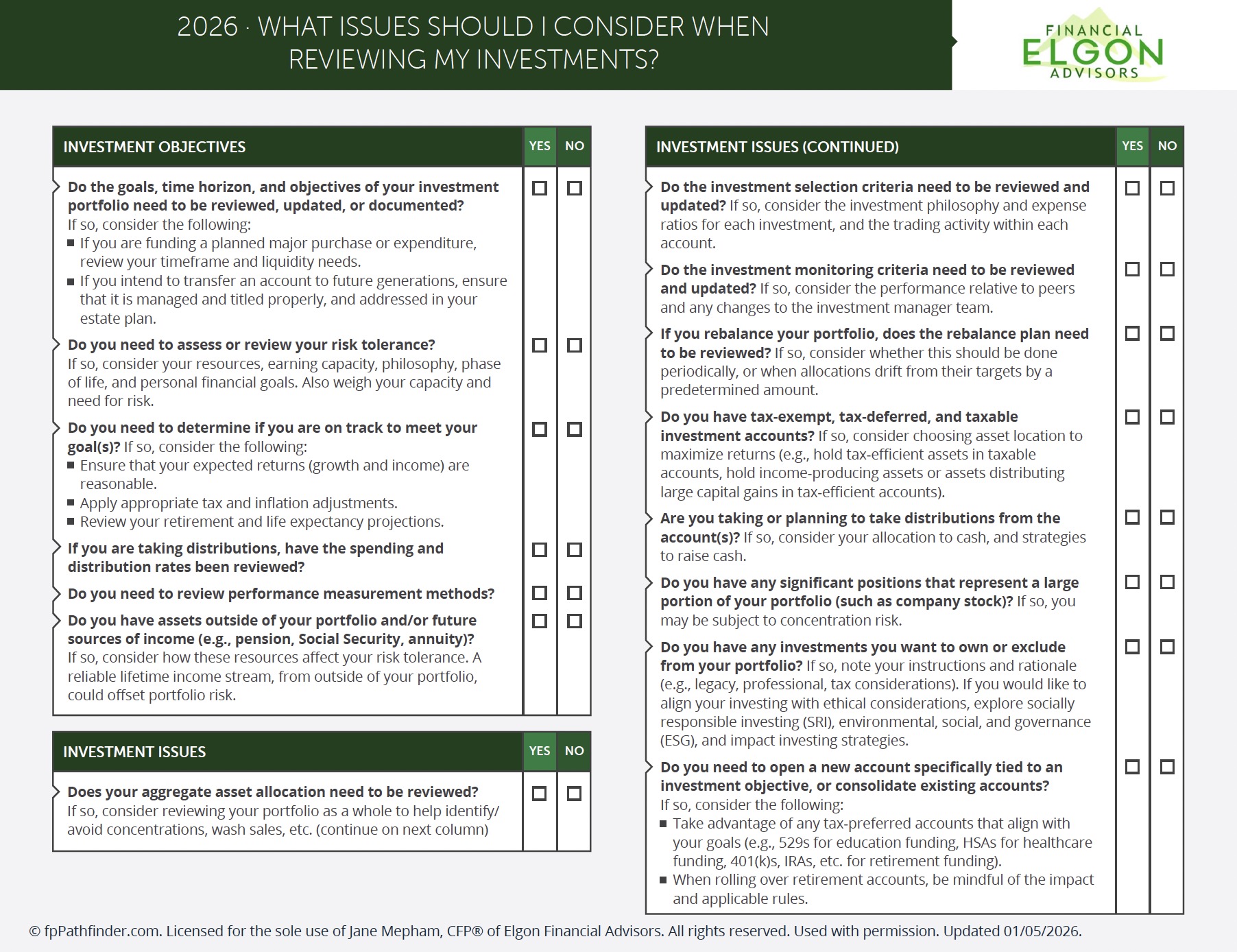

What are the tax considerations for receiving gifts from overseas families when you live in the US and you are a tax resident?. Updated extensively with 2026 data.