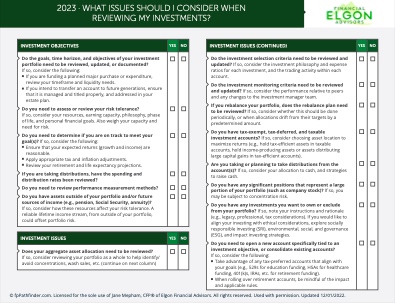

How to Fix The Overseas Tax Compliance Issues That Can Destroy Your FIRE Strategy On A Work Visa

Part of being able to successfully implement the FIRE strategy on a work visa is saving or minimizing on taxes.

Having to pay tax penalties because of tax-compliance issues goes against that. In this post, I discuss ways to be tax-compliant with overseas assets and avoid having to pay tax penalties.