In today’s post, I discuss some useful tax vocabulary to know and be aware of as you get ready to file taxes, especially if this is your first time to file taxes in the US, or simply the first time to file taxes on your own.

Basic Tax Vocabulary To Know And Be Aware Of As You File 2022 Taxes

Taxes are complicated, which leads to making mistakes, which can and do impact your financial life. You want to ensure you understand the tax vocabulary, as used in the US tax code.

It’s important to understand a few basics about taxes and if you are already familiar with them, consider this a refresher. This does not cover everything, but it will give you enough info to get started on your tax journey.

I’ll define the tax vocabulary in the form of questions to simplify things.

Tax Brackets And Filing Status

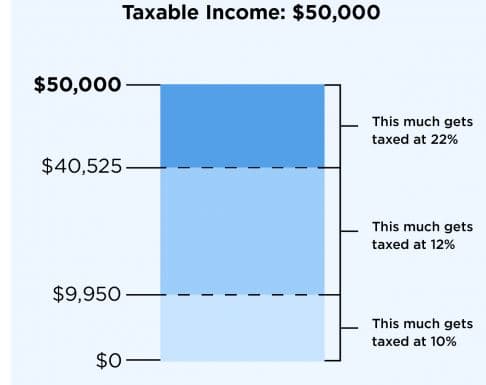

Tax brackets are one of the most misunderstood aspects of taxes. A lot of folks assume that you pay taxes at your tax bracket currently, but it’s a little more nuanced than this.

The big misunderstanding – if you are in the 37%, you are going to pay 37% of your income in taxes. This is not true.

Tax brackets show you the tax rate you’ll pay on each portion of your income. There are seven brackets for 2022: 10%, 12%, 22%, 24%, 35%, and 37%. The final number is determined by your tax filing status.

There are five filing statuses: –

Single,

Married filing jointly,

Married filing separately,

Head of household,

Qualifying widow(er)

Please pay attention if you are coming from a country like Canada where the filing status is individual.

What About If You Are Married to a Non-US Citizen?

This is where things start to get interesting, especially if you are brand new to the US. You have the option of filing separately or filing jointly.

The final decision is determined by whether your non-US citizen spouse is considered a tax resident or a tax nonresident.

Is The Marginal Tax Rate The Same As the Effective Tax Rate?

The marginal tax rate is the rate you pay on an additional dollar of income. This is the same rate as your tax bracket.

The effective tax rate is your average tax rate or the percentage of your taxable income that you’ll pay in taxes. In other words, the share of your total annual income you’ll need to pay in taxes.

Average Tax Rate = Total Tax Paid / Taxable Income

This is the more accurate representation of how much you pay in taxes.

This graphic from Nerd Wallet illustrates the point clearly.

From Nerd Wallet

With an income of 50k, your total tax bill is $6800, which is 14% of your income.

Hence your effective tax rate is 14%, while your marginal tax rate is 22%.

What’s The Difference Between A Tax Credit and A Tax Deduction?

According to Investopedia, a tax credit is the amount of money you can subtract directly from the taxes you owe.

The type of credit you get is determined by factors like your filing status, income, etc. They are three types of tax credits

Nonrefundable

Refundable

Partially refundable

Refundable credits are the most beneficial type of credit. They lower the tax bill due, and if they reduce the bill to below $0, you’ll be due a refund from IRS.

A great example of this is the premium tax credit which helps you cover the cost of premiums for health insurance purchased in the health insurance marketplace

On the other hand, a tax deduction is an amount you can deduct from your taxable income, which will likely reduce your tax liability. Essentially lower the amount of taxes you pay.

There are two ways to complete this

Standard deduction – a fixed amount based on your tax filing status

Itemized deductions – you combine a bunch of deductions like mortgage interest, charitable gifts, etc. If this total is greater than the standard deduction, it makes more sense to use use it, but everybody’s situation is different.

This is an area that’s constantly changing, so check with a professional regularly

A tax credit is more favorable than a tax deduction.

What’s The Difference Between Taxable Income (AGI) and Gross Income?

The best way to explain the difference is as follows

Gross Income – Adjustments to Income = Adjusted Gross Income (AGI)

Adjustments to income include things like deductions, retirement savings, etc. Anything that lowers your income.

Gross Income is the sum of all your income which includes any overseas income.

Adjusted Gross Income (AGI) is what you end up paying taxes on.

Final Tax Vocabulary To Know – State Taxes

The above illustrations apply to federal taxes, understand you’ll also need to pay state taxes. Each state calculates its taxes differently.

In addition, nine states including Texas and Nevada have no income taxes.

I recommend finding a professional like a CPA or Enrolled agent to help you with taxes, especially your first year. If you have overseas assets, then ensure the professional is familiar with international tax matters, especially if you need to file FBARS and need to include overseas income.

Happy to introduce you to professionals in Elgon’s network.

Need Help Figuring Out The US Financial Landscape?

Free Financial Assessment

If not ready to start, that’s okay, but please stay on top of our regular updates by email, or by joining here. Sign Up Here.

6 Things to Do

When Starting A Job on H-1B Visa

You are starting a new job on a work visa, there are some critical things, that will set up for financial success in the first 3-6 months. Download the free guide below for the detailed list!

We never spam. By signing up you’ll also receive access to future resources right to your inbox.

Disclaimer: This article is provided for general information and illustration purposes only. Nothing contained in the material constitutes tax advice, a recommendation for the purchase or sale of any security, investment advisory services, or legal advice. I encourage you to consult a financial planner, accountant, and/or legal counsel for advice specific to your situation. Reproduction of this material is prohibited without written permission from Jane Mepham and all rights are reserved. Read the full disclaimer here.