Updated 3/11/2025

In today’s updated post, I discuss how to prepare for a layoff on a work visa.

Market (Stock Market) Conditions And Work Visas

With the current decline in the stock market, companies are likely to see their prices decrease.

This means they will likely start laying people off, including those on work visas.

So, if on a work visa, how do you prepare for this situation, especially considering that the work visa is what allows you to stay in the US?

I have also included new resources to help you in this situation.

The recent tech layoffs have left many individuals on work visas, such as H-1B, TN, L-1, and O-1, feeling jittery.

Unfortunately, layoffs have become the norm, and everybody needs to prepare for that eventuality.

Indeed, one of the biggest threats to your finances on a work visa is the possibility of losing that job.

If on a work visa, the goal is to avoid having to scramble at the last minute with only 60 days to find another job.

I assume you want to stay in the country as a permanent resident. Or, if you ever need to leave, you can do so on your terms.

If so, here are some things you can do to prepare and be in the best possible position.

Prefer to listen? Our podcast episode on dealing with the biggest threat to your finances on a work visa.

Become A Student Of Your Visa Type

Being prepared for a possible layoff means understanding your visa situation completely.

If that’s your goal, understand what type of visa you have, its validity, limitations, etc., and the path to permanent residency.

I get that you have other things to worry about and become familiar with in the US, but this needs to be at the top of your list.

For example, with the H-1B visa, there are different types of permanent visa categories you can use to get your green card, some more advantageous than others.

You want to know what those are.

Understand the validity period of the visas. For example, the H-1B visa is valid for three years and can be renewed for an additional three years. With an approved 1-140, it can be renewed indefinitely.

L-1 is good for 3 years and can be extended to 7.

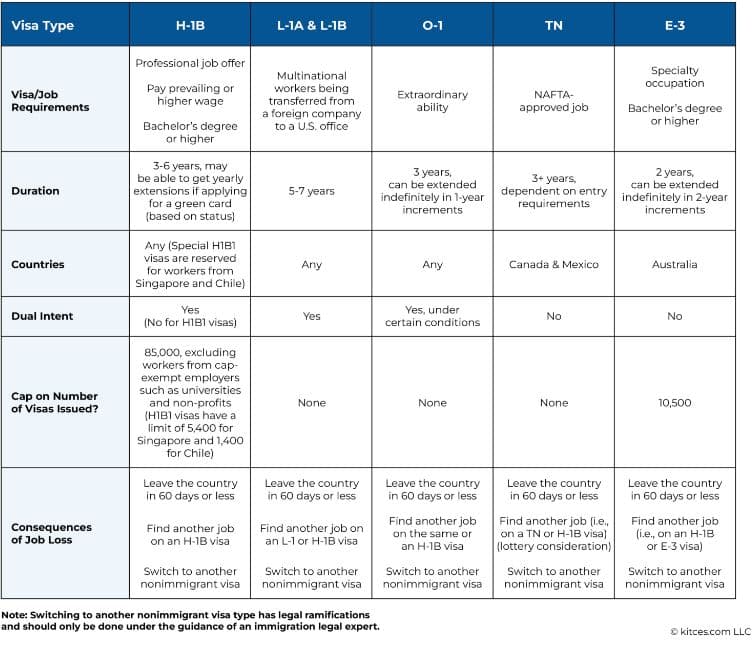

This graphic summarizes the duration, dual status, and, more importantly, what happens under each visa if you lose your job.

From Kitces – Understanding Investing Challenges For Nonimmigrant Work Visas Holders.

Understand priority dates based on your country of origin, how long each green card stage takes, and what the premium processing entails.

You want to be armed with all this information when you finally talk to the legal folks.

Here are some green card stats, you’ll find interesting.

Get Your Green Card Process Started In Preparation

Preparing for a layoff on a work visa means having a way to stay in the country after the event.

Many companies are willing to file for your permanent residency and usually will let you know during the interview process.

Once you start the job, the priority quickly shifts to benefits (good) and being productive. But that risks your situation.

If your company has agreed to file for you, you must know exactly when they plan to start the process and get a firm deadline commitment.

It can be sometimes hard to ask when you are new, but this is your life. Be bold, curious, and express why.

Make filing a priority.

If they start dragging their feet or won’t commit, finding another employer willing to start the process ASAP is okay.

When I started out, I had somebody in HR tell me, that they would not start my green card process, right away and advised me to get going with my masters program instead.

This is a case where our priorities were not aligned. I ended up leaving that job, and as part of the next interview, I knew enough to bring this up.

I understand times are different, but do everything you can, to get this addressed from the get go.

Get Your Green Card Filed Under the Best Category

Typically, companies have different immigration attorneys that they use.

Before they start the process, have a conversation with them, and find out exactly how they intend to file the green card for you, and which EB category they plan to use.

Some categories like EB-2 are advantageous and, in some cases, you can petition for yourself based on your skill set.

To self-petition use a lawyer outside your company – more about this budget item later.

Because each stage takes a while, many immigration lawyers advocate for starting this ASAP.

Consult With An Outside Attorney

Company lawyers are more likely to favor the employer, so I always recommend having your lawyer.

They are great, especially when you are doing the initial legwork and want to understand what you need to know, and the correct questions to ask. It will cost money, but this is an investment in your future – I address this later.

If you decide to self-petition under the EB-2 NIW category, you want a great attorney.

They’ll be able to advise you on the process and how you can get this done while the company process is ongoing.

Just like when looking for a financial advisor, it’s worth interviewing a couple while you have the time to evaluate them.

Can Your Spouse Get A Work Visa?

If your spouse is on a dependent visa, consider having them find a job on an H-1B visa if possible.

I meet a lot of families, where both spouses are highly qualified, but one came in on a dependent visa.

If they get a job, it will mitigate having to leave the country in 60 days if the primary visa holder gets laid off.

Consider Other Ways Of Getting Your Permanent Residency

Apply for the Green Card Lottery. Every year, about 55,000 people get their residency this way.

If married, have your spouse apply, increasing your chances of winning.

Start a business. Companies like Unshackled are looking to invest in immigrants on all kinds of visas, allowing them to start their ventures.

A word of caution – tread lightly here and consult an attorney.

Your visa is tied to your job, and working another job would violate your legal status.

Improve Your Technical And Soft Skill Sets

One way to recession-proof your financial future is to invest in yourself. You want to make yourself attractive to future employers and give yourself more options if you get laid off.

Anytime you are looking for a new job, you are competing with tens if not hundreds of other candidates.

How do you set yourself apart?

Short courses can help a lot, but longer-term studies like a master’s program can also be advantageous.

They give you a shot at being able to apply for the EB-2 category or possibly EB-NIW.

The education component can be extended to the dependent spouse. Have them pursue courses that make them attractive to employers now or in the future.

Keep your resume updated.

Network, Network, Network

This is the best time to network and get your name out.

Join professional organizations in your industry and volunteer to help where possible.

Find people who can be mentors and learn from them. Find out what leadership and technical skill set you need to become a leader in your industry.

If it means switching jobs for a better trajectory – do it.

Financial Decisions – To Prepare For A Layoff On A Work Visa

Spending Plan – Have a bucket for career advancements and legal fees. The attorney fees are not always cheap, but a good immigration lawyer is worth their fees. Make it a priority.

Emergency Fund – Maintain a 12-month emergency fund in a high-yield online savings account that is easily accessible. This is higher than typical, but if you have to leave the country, you’ll be glad to have this money.

Defer Big Money Decisions – Hold off buying a house, until you have the green card process started and further along. Hold off on major financial commitments in the US, that require your permanent status.

Investments – Prioritize investing in a taxable account outside of work. I have discussed the importance of a taxable account for foreign-born families, and this is a perfect use case.

Simplify Your Finances – This is not the time to dabble in individual stocks (tons of research), or have investing accounts everywhere, or research different investment ideas. Instead focus on your career, and consider having a professional help you simplify things.

Tax Compliance – Ensure you stay compliant, especially if you have overseas accounts to avoid financial penalties.

New Resources

Other resources – this question has come up in different ways. Manasa and I have addressed it a couple of times in the podcast. Here are the episodes where we address it.

Mitigating Concerns After The Elections – Focus On What You Can Control

Addressing The Biggest Threat To Your Financial Life In The US

With the above steps, you’ll be well-prepared to deal with the situation calmly if you are on a work visa and you are impacted.

Need Help To Prepare For A Possible Layoff?

We help foreign nationals on work visas (H-1B, L-1, TN, O-1, E3 etc), invest prudently, reduce taxes. A part of this is addressing threats that could impact their status in the US.

You don’t have to go it alone.

Free Financial Assessment

If not ready to start, that’s okay, but please stay on top of our regular updates by email, or by joining here. Sign Up Here.

6 Things to Do

When Starting A Job on H-1B Visa

You are starting a new job on a work visa, there are some critical things, that will set up for financial success in the first 3-6 months. Download the free guide below for the detailed list!

We never spam. By signing up you’ll also receive access to future resources right to your inbox.

Disclaimer: This article is provided for general information and illustration purposes only. Nothing contained in the material constitutes tax advice, a recommendation for the purchase or sale of any security, investment advisory services, or legal advice. I encourage you to consult a financial planner, accountant, and/or legal counsel for advice specific to your situation. Reproduction of this material is prohibited without written permission from Jane Mepham and all rights are reserved. Read the full disclaimer here.