Financial detours are a hidden opportunity. Let me explain.

Financial dreams are very linear – move from point A to point B, encountering success at every point.

Go to college, graduate, get a great job, make a ton of money, and retire to play golf. Or something to that effect.

Move to the US, attend your dream school, start a company, make a ton of money, and help family back home…. you get the idea.

Not knowing how the future will play out causes us to gloss over the details, that will make the dream a reality.

It’s probably the major cause of financial detours. There are also things we have no control over.

What Causes Financial Detours

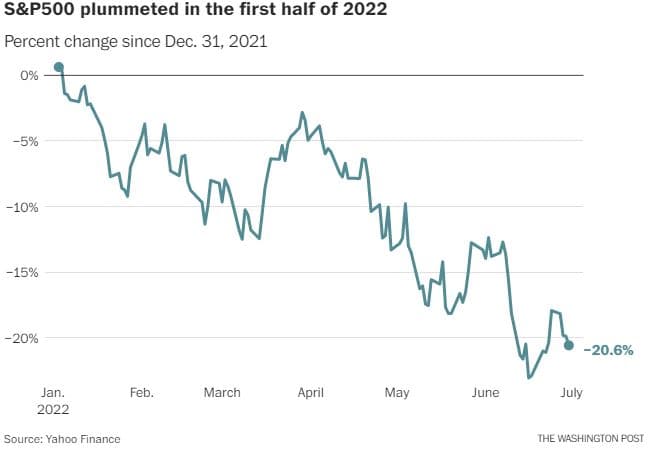

The current stock market has had a huge impact on a lot of portfolios. Since January 2022, the S&P 500 was down 20.6%, as of June 30th. Nasdaq is down close to 30%. These are two of the metrics we use to determine how the markets are doing.

If you were planning on retiring any time in 2022, this will force you to adjust your plans. You’ll need to take a new financial detour to try and make yourself whole.

My assumption though, is that you probably should not have been that heavily invested in the market, or you have a pile of cash to get you through the first couple of years of retirement.

The overused phrase, life happens applies here. Things don’t work out as you’d planned.

Your child did not get admitted to the college they had in mind, and you are now scrambling to figure out an alternative.

Your attorney had assured you that you’ll have your green card in 5 years, but you are now in year 7 and still waiting.

You did not get that promotion you’ve been counting on.

Your spouse has just been laid off.

You’ve been doing everything right, but you are forced to take a detour because you are not fully in control.

Be Okay with Financial Detours

It’s scary to wake up one day and see your dreams come crashing down, because of things happening that you may or may not be able to control.

It’s okay to mourn the loss of what could have been, and it’s okay to give yourself some space to deal with it.

Few of them are pain-free, or stress-free, but what really matters is what you do onwards.

It’s tempting to consider yourself a financial failure, but I believe, there is always a way out, and out of failure, can be great triumph.

So be okay with change, and do the best you can to manage. Above all do all you can to protect yourself from some of the consequences.

Getting Past the Financial Detours

If you are out for a drive and you suddenly find yourself hitting a roadblock, you have two options

Pull off to the side of the road and throw a major tantrum or worse beat yourself up for having gotten into the jam – it may make you feel better but does not accomplish much.

Find a way to get around the block, look for detour signs, and with today’s technology, have your GPS redirect you – A much better option

I tend to see a lot of option 1’s, which sadly just makes the situation worse. I completely understand how scary that can be, and I’m the first person to say no (it doesn’t matter how we got there), what matters is what we do onwards.

The guilt you sometimes feel, especially if you think you made a money mistake can be debilitating and affect a lot of other areas.

We don’t talk a lot about money in our society, and this can and does compound the issue. It’s okay to talk about it, to voice your fears, and your frustration to get past the money taboo (2).

A trusted financial advisor can help you with this, especially if you need to reset.

Does it help to know, that you are probably not alone?

Does it make it any easier to take in when you realize that just because people are not posting about their forced financial detours on social media, they are still experiencing them?

Financial Detours – A Hidden Opportunity

John Maxwell says, “Everything worth having is uphill.

A detour can become a highway to greater things. Through different lenses, it could be the opportunity you’ve been waiting for.

It’s a chance to try out options B, C, and possibly D.

Take Care of the Basics to Minimize the Effects of a Detour

To ensure you can survive a detour, take care of the basics first. If your answer to the following questions is yes – you are ready.

If it’s mostly – yes, you are doing great, but there is some room to make things better.

If you are mostly in the no’s category, you are in luck. This is a situation that can be fixed if you act on it today.

Do you have a spending plan?

Do you have an emergency fund that would cover your expenses for 3-6 months? If you have family overseas you might need to visit on an emergency basis, it should include return tickets for the whole family.

Are you saving regularly and investing in different asset classes?

Are you tax-efficient?

If you have overseas assets, are you staying on the right side of the taxman?

Are your income and your family protected?

Are you staying grounded in your family life?

Once you have that in place, and you understand life happens, you have an excellent chance of dealing with any detours and possibly enjoying the new path.

Need Help?

Financial detours can complicate your path to financial freedom. We are here to assist you in any way we can. Click here if you’d like to set up a meeting and chat on the above topic or any other financial issues that affect foreign-born families in the US.

To stay on top of Elgon’s blog posts by email, please sign up here.

Sources

(1) https://www.washingtonpost.com/business/2022/06/30/stock-market-today-recession-inflation/

(2) https://www.theatlantic.com/family/archive/2020/03/americans-dont-talk-about-money-taboo/607273/

6 Things to Do

When Starting A Job on H-1B Visa

You are starting a new job on a work visa, there are some critical things, that will set up for financial success in the first 3-6 months. Download the free guide below for the detailed list!

We never spam. By signing up you’ll also receive access to future resources right to your inbox.

Disclaimer: This article is provided for general information and illustration purposes only. Nothing contained in the material constitutes tax advice, a recommendation for the purchase or sale of any security, investment advisory services, or legal advice. I encourage you to consult a financial planner, accountant, and/or legal counsel for advice specific to your situation. Reproduction of this material is prohibited without written permission from Jane Mepham and all rights are reserved. Read the full disclaimer here.