2024 promises to bring higher numbers when it comes to your finances. Overall, the numbers will help you save more. In this post, I’m going to discuss the key financial numbers you need to know in 2024.

Curious about how much you can now save into your 401k in 2024, or how much you can save into your Roth IRA.? Want to know about other numbers?

For the details keep reading. (PS: The answer is $23,000 and $7,000 respectively.)

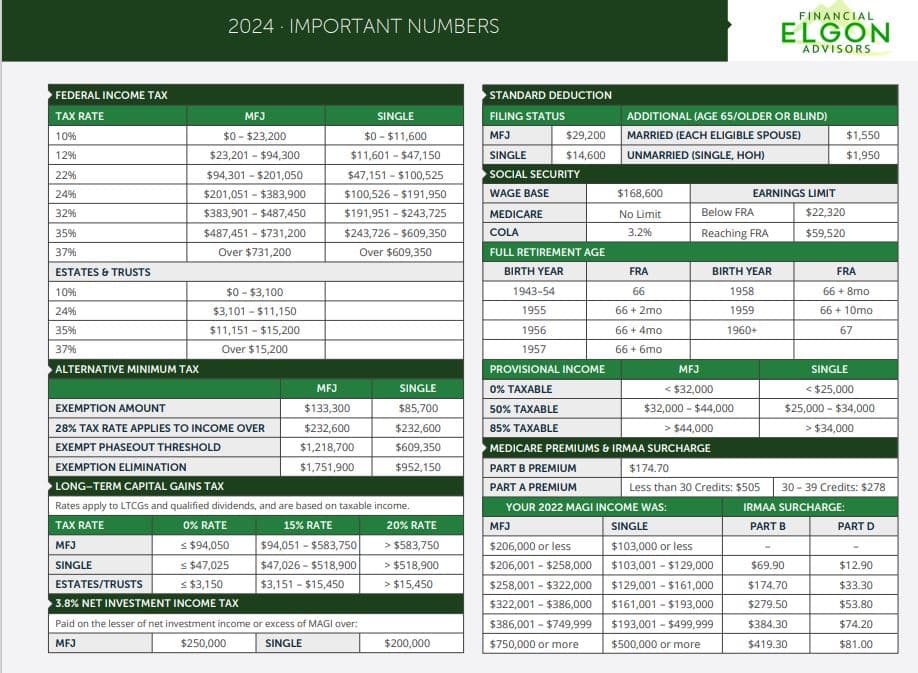

I’m going to make this very easy for you, by providing you with a nice downloadable chart – no email required. Save this on your desktop and use it as a reference guide.

The Key 2024 Financial Numbers Highlights

The Roth IRA income limit has gone up. If single, your MAGI (Modified Adjusted Gross Income) needs to be under $161,000 and if married, it should be under $240,000.

Of course, if your income is above the above number, a Roth IRA conversion can help you get around this.

MAGI – Modified Adjusted Gross Income

The MAGI is your AGI (Adjusted Gross Income) with a few more items added back.

AGI is your gross income less adjustments to income. Examples of this are pre-tax contributions, but not the standard deduction. One way of lowering your AGI is to contribute the maximum amount possible to your work retirement accounts.

The AGI can be the same as the MAGI, but not always.

With the new numbers, please check to see how much you are putting into your retirement accounts, and if possible, consider adjusting the numbers.

As I have pointed out in the past, the Roth IRA is not for everyone based on your visa status, and where you think you might end up retiring.

But if not in that situation, it is worth looking to see if you can save more.

Tax Rate Brackets Going Up

In the post Useful Tax Vocabulary To Know, I describe the basics to know when it comes to the tax landscape. Some of these are tax brackets, marginal tax rates, effective tax rates, etc.

In 2024, the tax brackets have gone up due to inflation. For example, last year, the limit for the 37% was $578,125, this year it’s $609,350 if filing single. All the tax brackets have changed.

Long-Term Capital Gains Rate Going Up

If married filing jointly the 15% rate is now for income between $94,051 to $583,750. Keep in mind that capital gains will increase your AGI and your MAGI. This is a planning opportunity where we can figure out the best time to recognize gains.

An interesting thing is that if your AGI is less than $94,050, married filing separately, your capital gains tax is 0.

Standard Deduction Going Up

The standard deduction is going up to $29,200 if your filing status is Married Filing Jointly and $14,600 if filing Single.

This number is important because if you are to make use of itemized deductions, you need to have them add up to more than the standard deduction.

This is where we can use things like bunching deductions to give you more in one year.

Gift and Estate Tax Going Up

In 2024 you can give an individual up to $18,000 without it counting towards your lifetime gift exclusion, this year the number stands at $13.61 million.

For US nonresident noncitizens, the lifetime gift exemption is $60,000, which means anything over $18,000 will most likely incur a gift tax.

529 Plan Can Be Rolled Over to Roth IRA

This is not in the key 2024 financial numbers chart, but starting this year, if there is money left in your 529 account, you can do a rollover into a Roth IRA. This was part of the Secure 2.0 Act.

There are a few conditions. The beneficiary needs to have been on the account for 15 years, and the yearly conversion will be based on the yearly Roth IRA contribution amount.

There is a lifetime limit is $35,000, which means this will end up getting spread out over a couple of years.

So, if you haven’t started a 529 account, because you were afraid, you might not use all the money, this should allay your fears.

Of course, if you are not sure, that your kids are going to be in the US, by the time they go to college or if you can’t start a 529 plan because your beneficiaries don’t have a social security number or ITIN, the brokerage account is still a great option for you.

So as you plan your year, and figure out what needs to change in your situation, keep these key 2024 financial numbers in mind.

The Free Download: The Key 2024 Financial (Important) Numbers

To get the PDF, click on this image, and you should be able to save a copy to your computer.

Use this chart as a guide or just a way to start thinking about some things you may not have considered.

Need Help With Your US Finances?

Check out our process that will help you evaluate our services, and let you make an informed decision about working together.

Get Started Now

If not ready to start, that’s okay, but please stay on top of our regular updates by email, or by joining here. Sign Up Here

6 Things to Do

When Starting A Job on H-1B Visa

You are starting a new job on a work visa, there are some critical things, that will set up for financial success in the first 3-6 months. Download the free guide below for the detailed list!

We never spam. By signing up you’ll also receive access to future resources right to your inbox.

Disclaimer: This article is provided for general information and illustration purposes only. Nothing contained in the material constitutes tax advice, a recommendation for the purchase or sale of any security, investment advisory services, or legal advice. I encourage you to consult a financial planner, accountant, and/or legal counsel for advice specific to your situation. Reproduction of this material is prohibited without written permission from Jane Mepham and all rights are reserved. Read the full disclaimer here.