During the holidays gift giving stress is a reality for a lot of Americans.

Last week the gift giving topic around the holidays came up at a small social gathering. We discussed what’s causing people the most stress at this time of the year.

The issue of how much to spend was front and center, in addition to other aspects of who to spend it on.

As a country we spend a lot of money on giving gifts.

In 2019, American consumers spent more than $1 trillion for Christmas. This works out to be an average of $942 on gifts alone per person. This year this number is up to $998.

In our discussion, almost everybody reported being stressed out when it came to navigating the gift giving journey especially with their spouse.

The following quotes highlights some of the concerns. These are not specific to any group, and they are the same comments you are likely to hear anytime gifts and the holidays are discussed

“I really don’t want anything, but my spouse is already stressing out about what to get me”

“They got me a great gift last year, so I need to get them something better this year”

“What do you buy for somebody who has everything? and yes I have to buy them something”

“We are going through a rough patch in our lives now, and I want the kids to be okay, so we are looking to get them lots of gifts”

“You don’t know my mother-in-law; she equates love with how much I spend on her”

“I didn’t get much growing up, so I want my kids to have whatever their heart’s desire, a little credit card debt is okay on this. My spouse disagrees”

“What if they don’t like the gift, I give them this year?”

Gift-Giving Stress And The Holidays

The discussion goes to show how stressed out we all get around the holidays with the whole gift-giving ritual.

Research shows that about 60% of Americans find holiday gift-buying to be the most financially stressful event of the year.

It’s more stressful than tax season according to the same research.

What makes it even worse is that 62% of Americans expect to get an unwanted gift which equals 154 million people receiving gifts worth more than $15 billion.

Sadly half of this will be re-gifted or returned to the store.

So much unwanted stress from what should be a joyful occasion.

Gift Giving And Other Cultures

This got me thinking about my childhood. I grew up in a country where the holidays were defined more by celebrating being with friends and families, than by giving and exchanging gifts.

If we were lucky, we may have gotten a new outfit for the holidays, but that would have been the extent of the gift-giving. A few families went beyond that, but that was unusual then.

Based on conversations, I have with other foreign-born families, there are quite a few other countries, where this is the norm. Every country has it’s own nuances though.

For those who are now bringing up kids in the U.S., it’s another issue (not necessary a problem), but something we need to consciously decide on.

Do we continue practicing what we grew up with or do we adapt the customs and traditions of our new country?

There are a lot of solutions offered by experts on how to deal with the stress of gift-giving. The solutions range from having a budget to starting the shopping process early amongst other practical actions.

They work to some extent, but until you get down to the root cause of the issue, and understand why you behave the way you do, you can’t fully solve that money conflict.

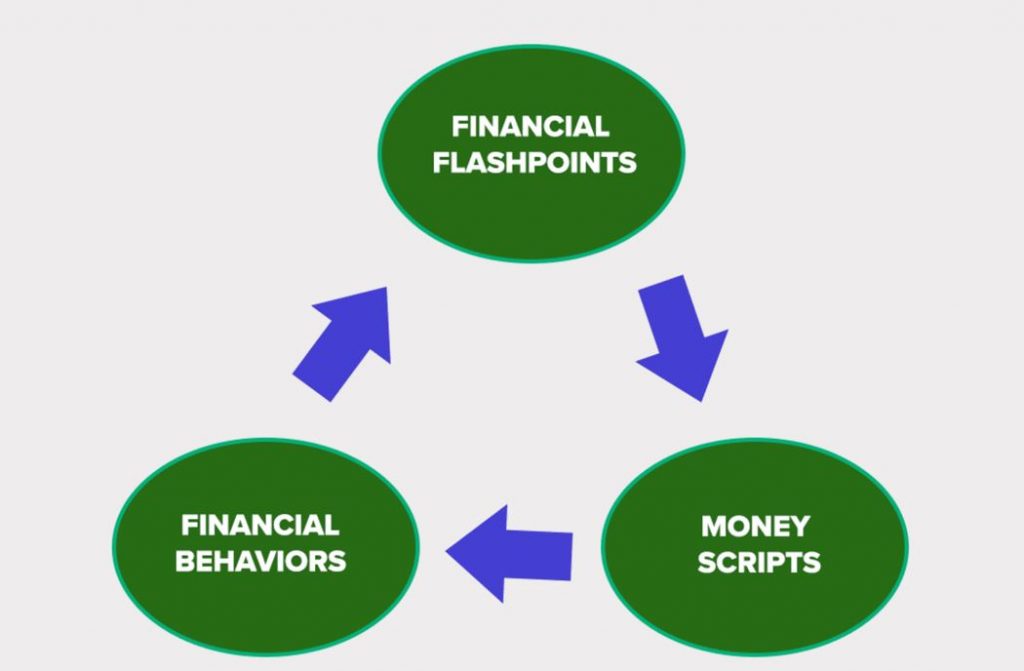

Defining Money Scripts

Comparing the two scenarios (US, and other countries), is the perfect example to describe the unconscious beliefs we have about money.

This belief guides our every money behavior and decision including gift-giving.

In the behavioral finance arena, these are called “Money Scripts”. The term was coined by financial psychologists Dr. Brad Klontz and Dr. Ted Klontz (father-son duo) in their book Mind Over Money

These money beliefs go back to our childhood, in what Dr. Brad Klontz calls Financial Flashpoints.

The flashpoints are experiences around money that leaves a lasting imprint in your financial life that tends to drive your adult behavior.

Credit to Bradley T. Klontz, Psy.D., CFP

The beliefs may be passed down from one generation to the next and they are determined by your family makeup and your cultural background.

If you know what somebody’s money script is, it’s easy to predict their behavior, around finances.

How To Identify Your Money Scripts

There are a couple of ways to identify your money script. In my practice, I use Money Quotient True Wealth Planning Process to help clients and prospects uncover their beliefs about money.

At a high level, asking yourself these types of questions will hopefully help you start to figure out your financial flashpoints and begin to understand your hidden beliefs about money.

What did you learn about money growing up?

What’s your earliest memory of money?

What did your parents teach you about money?

The Link Between Gift Giving And Money Scripts

Back to the group, I started this type of question to get everybody thinking about their background. I was convinced that the different viewpoints came from the partners having different money scripts.

Some of the couples in the group that always assumed they were similar in everything, started to realize that there could be some fundamental differences in how they approached money decisions.

And the root of the differences is that they were dancing to a different money tune.

A Different Holiday Spending Experience

To help you through this holiday season and to hopefully cut down on the stress of gift-giving, try and get to the bottom of your money scripts.

In addition to the questions above, try the following questions that might allow you to look at your situation through different lenses.

“Why is it so important to give your nephew that present that you really can’t afford, and you are not even sure he needs?”

What does it mean for you to give him that specific gift”?

Go back to your childhood.

“What did gifts mean for your family? How was the whole gift-giving tradition where you grew up?

The tough one – and it helps to write this one down. Consider the following questions

“What’s the worst thing that would happen if you did not give your nephew that present?”

“What if instead you choose to do some activities or a trip with him in future?”

“What if you asked him what he’d really like and be prepared to take whatever answer that he comes back with?”

The answers might pleasantly surprise you and allow you to lessen your gift-giving stress at this time of the year.

Need Help Talking Through Your Money Scripts?

Free Financial Assessment

If not ready to start, that’s okay, but please stay on top of our regular updates by email, or by joining here. Sign Up Here.

6 Things to Do

When Starting A Job on H-1B Visa

You are starting a new job on a work visa, there are some critical things, that will set up for financial success in the first 3-6 months. Download the free guide below for the detailed list!

We never spam. By signing up you’ll also receive access to future resources right to your inbox.

Disclaimer: This article is provided for general information and illustration purposes only. Nothing contained in the material constitutes tax advice, a recommendation for the purchase or sale of any security, investment advisory services, or legal advice. I encourage you to consult a financial planner, accountant, and/or legal counsel for advice specific to your situation. Reproduction of this material is prohibited without written permission from Jane Mepham and all rights are reserved. Read the full disclaimer here.