Last week, I spoke to somebody who wanted to know what the best option is for saving money.

In other words, where to save his money, and also what order to use, and be able to answer the question “where should the next dollar go?”

He had a couple of questions, which are very similar to what I see from others. The questions are about things like

Where and how do you start saving money?

Are you leaving too much in the savings accounts?

Are you allocating enough to all the things you should be thinking about?

Are you ready to invest your extra cash, and if so, where should that go?

In summary, what are the best options to save money today?

A Possible Solution – The Best Option To Save Money

It can get a bit overwhelming trying to address all the questions and keep everything straight in your head.

We help you with a lot of the above issues throughout the year if you work with us. But we also do way more than that, for example, risk assessment, emergency funding, investments, estate planning, etc.

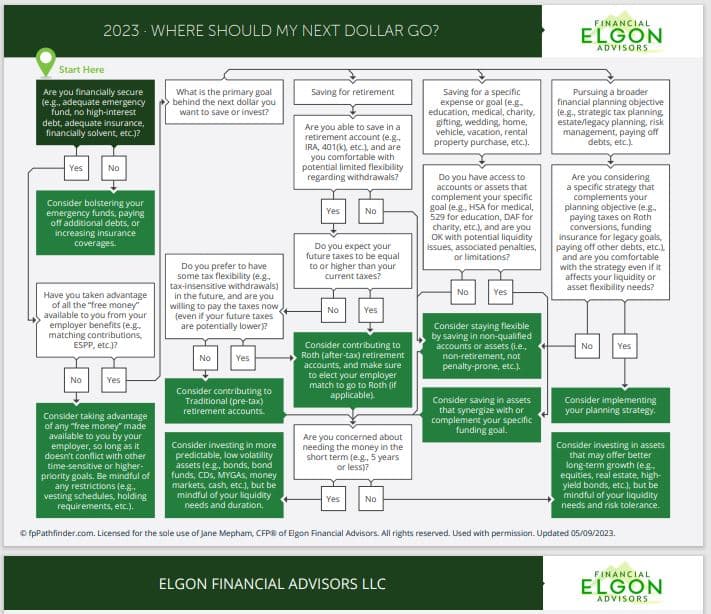

So, to help you think about this particular issue – what’s the best option to save money, we’ve created a free downloadable chart, that you can use as a guide.

Some of what’s in the chart may not apply to you, if you are in the US on a temporary work visa, or you are planning on retiring overseas at some point. But it’s great information to have.

We’ve addressed some of the unique challenges you face if foreign-born or if you a foreign national on a work visa in the US

For you, your priorities are likely going to be different, and there are some things you should prioritize over others.

Use this chart as a guide or just a way to start thinking about some things you may not have considered.

To get the PDF, click on this image, and you should be able to save a copy to your computer.

Where to save your money!

What’s the best option to save money?

Need Help With Your US Finances?

Get Started Now

If not ready to start, that’s okay, but please stay on top of our regular updates by email, or by joining here. Sign Up Here

6 Things to Do

When Starting A Job on H-1B Visa

You are starting a new job on a work visa, there are some critical things, that will set up for financial success in the first 3-6 months. Download the free guide below for the detailed list!

We never spam. By signing up you’ll also receive access to future resources right to your inbox.

Disclaimer: This article is provided for general information and illustration purposes only. Nothing contained in the material constitutes tax advice, a recommendation for the purchase or sale of any security, investment advisory services, or legal advice. I encourage you to consult a financial planner, accountant, and/or legal counsel for advice specific to your situation. Reproduction of this material is prohibited without written permission from Jane Mepham and all rights are reserved. Read the full disclaimer here.