Updated 1/28/2026

One of the biggest challenges for new immigrants to the US is the lack of a US credit history.

In today’s post, I’ll describe how to build US credit from zero.

Before addressing the credit question, here are a few other resources that can be very helpful to new immigrants or foreign nationals on work visas.

10 Financial Mistakes That Will Derail Your American Dream

New Job on H-1B Visa: How to Succeed Financially

How To Determine Your Tax Residency Status – It’s Not the Same as Your Immigration Status

So, let’s break down the US credit score, what it’s used for, how to start building it with zero credit history, and finally, how to improve it once it’s established.

To read this at your leisure, this free download has all the details: How To Build US Credit Starting From Zero

What Is A US Credit Score?

A credit score determines your likelihood of paying debt back. It predicts how well you manage debt (borrowing and paying back money).

It’s calculated using the information in your credit report. There are different types of scoring, which I’ll address later in this post.

The credit score is critical in the US, as it’s heavily relied on by almost everyone to judge your financial standing. The question is how one goes about building it as a newcomer.

Who Is Using Your Credit Score And Credit History?

Third-party lenders, such as banks, credit card companies, car dealers, and mortgage lenders, will use it to assess the risk of lending money to you.

They use the score to determine what type of interest rate to give you. Apartment owners rely heavily on credit scores to determine if you are worthy of becoming their renter.

The same scores are also used to determine auto and homeowners insurance prices.

They will also determine the size of an initial deposit required to obtain a smart phone, cable service or utilities.

Employers sometimes check your credit report as part of the hiring due diligence.

They are looking for signs of irresponsibility and negligence, as well as a general sense of your decision-making skills and judgment.

How Your Credit Score Is Calculated

The US has three major credit reporting agencies (Experian, Equifax, and Transunion). Their job is to gather and collect your credit information and typically sell it to creditors for a fee.

Since the info they gather about you may be a little different, the score from each of them can also be a little different.

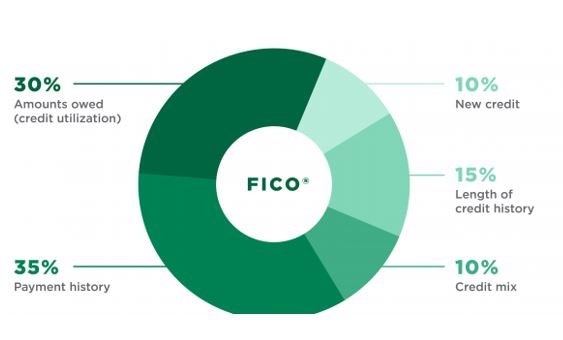

Your overall score is calculated based on the following factors

-

- Payment history – 35%

- Total amount owned (includes credit utilization) – 30%

- Length of credit history – 15%

- Type of credit – 10%

- New credit (includes credit inquiries) – 10%

There are different score calculations, the most common being the FICO Score, created by the Fair Isaac Corporation (FICO). It’s used by over 90% of lenders to judge your creditworthiness. It ranges from 300 to 850 and is based on the percentages above. The scores are grouped as follows

-

-

- 800 + Exceptional

- 740 – 799 Very Good

- 670 – 739 Good

- 580 – 669 Fair

- < 580 Poor

-

Another scoring system used to generate a credit score is VantageScore.

The three main credit bureaus developed this as an alternative to FICO Scores.

FICO scoring is based on each specific agency’s data, meaning you could have three different ratings, while VantageScore combines the data from the three agencies to create a single score.

The FICO scoring requires a credit history of at least six months, whereas VantageScore can work with a history of less than six months.

New Immigrants Have Zero US Credit History

When immigrants first arrive in the US, they have no US credit score since they have no US credit history. They are credit-invisible.

You could move to this country with thousands of dollars in your bank account but still struggle to find an apartment to rent based purely on your non-existent US credit history.

How To Build US Credit From Zero

Once you arrive in the country, there are a couple of things you can use to start building your credit history. This becomes the basis for creating your US credit.

First, apply for Social Security. If you are here on a work visa, getting the Social Security number will be relatively easy.

You can sometimes apply for the SSN in your home country when you apply for an immigrant visa.

If not eligible for SSN, apply for a TaxId Number (ITIN—Individual Taxpayer Identification Number). This can only be done when filing taxes when you have non-wages tax obligations.

The following sections will answer the question, “How do you build your US credit from zero as a new immigrant?”

Some don’t require your SSN, but having the number makes things go faster.

Open A Bank Account To Build US Credit From Zero

A banking relationship will be valuable as you navigate the US financial landscape. A few local banks and credit unions may be willing to open an account for you, but a bigger bank may prove more beneficial.

Most of them will require a visit to a local branch.

There are a couple of other ways to access a bank account.

-

-

International Bank Accounts. If your home bank is in the US, they may be willing to open a US account for you before you get here. Some examples of these banks include HSBC, Citibank, etc. The initial deposit and the monthly fee may be high, but based on the flexibility they are giving you, it may be worth it as you start out.

-

In addition, the same bank may be willing to give you a US credit card.

-

-

Partner Bank. Check with your home bank and confirm who their partner bank is in the US. While still in your home country, they may be willing to help you open a US bank account to be ready for you when you land.

-

Apply For An Unsecured Loan To Build US Credit From Zero

Stilt is a fintech company started by immigrants to provide loans to other immigrants to address the lack of US credit history.

You can borrow an unsecured personal loan on day 1 of your arrival in the US. According to the founder, Rohit Mital,

The company reports your payment history to the credit bureaus, helping you build your US credit from scratch.

The company does not require an SSN to apply for credit, although it reports on its website that having one can speed up the process.

Use Your Foreign Credit Report To Apply For A US Credit Card

Nova Credit is a cross-border credit bureau. The fintech company partners with credit bureaus in various countries, including Canada, the UK, Kenya, India, Nigeria, and South Korea.

With your permission, they’ll share your foreign credit history (translated to a US equivalent score) with US lenders to judge your creditworthiness.

If your country is included on its growing list, you can apply for US credit cards like American Express and Citi and start creating your US credit history right away.

Some cards don’t need SSN or ITIN numbers, but it’s always a good idea to check with the card issuers.

Nova Credit has also partnered with other business entities, allowing you to access auto loans, student loans, and apartment rentals.

The company was founded by immigrants who were tired of being credit invisible in the US.

Apply For A Secured Credit Card To Build US Credit From Scratch

You apply for a credit card and deposit a certain amount as a security deposit. This amount becomes your credit limit. For example, if you put down $500, you can borrow up to $500 on this card.

The deposit is not to pay down the monthly charges and interest, so ensure you are paying those on time.

To make the security deposit, you’ll need a US bank account and a US identification number (SSN or ITIN).

No difference exists in how the card’s activity is reported to the credit bureaus, making them ideal if you start from scratch.

Most of these tend to have a high interest rate since the creditor believes they are taking a risk with you. However, you can shop for one with no annual fee, reports to all three major credit bureaus, and offers a grace period.

Finally, in addition to paying the bill on time, credit utilization should be kept low, ideally at around 10% to 30%.

Over time, you can apply for an unsecured credit card, and in some cases, the credit issuer will offer you the new card unsolicited, based on your payment history, sometimes as an upgrade.

At that point, they may refund your security deposit.

Apply For Credit Cards That Use Other Factors Besides Credit History

These credit cards will consider additional factors, such as income, employment history, and banking history (including cash flow), to determine your creditworthiness.

An example in this category is the Petal Credit Card. It’s usually a good one for International Students on an F-1 visa looking to start building their US credit history.

Petal Credit Cards

If you are an immigrant without an SSN but have an ITIN number, the Petal credit card may be a good option for you.

The application process requires you to give Petal access to your banking information through a third-party provider.

The access allows them to consider factors such as your cash flow to determine if you can be trusted with credit.

If you don’t have a local bank, the company can obtain your banking information from major international banks like HSBC and Deutsche Bank.

The card has no annual fee and has features that help you manage money responsibly.

Some of these include defaulting to making the full payment, showing you how much interest you are paying if you don’t pay in full, cashback, etc.

But the activity will help you build US credit from zero.

Apply For A US Credit Card With A Co-signer Or Become An Authorized User

This allows you to benefit from somebody with a good credit history. If you ever fail to pay, the co-signer must understand they are on the hook for the balance.

You get your credit card linked to the primary holder’s account. Like co-signing, the primary holder is responsible if you don’t pay your bills on time.

Have Your Foreign Credit Card History Transferred To The US

The American Express Global Transfer Program allows you to use your American Express account history from your home country to apply for a US credit card.

You can apply for different credit cards, but the typical response is to give you the same card as what you already have in your home country.

Other Non-Credit Cards Ways Of Building Credit History

Foreign Executive Lease Program

The program gives international employees relocating to the US on a temporary work basis (non-immigrant) the ability to lease a new Ford or Lincoln vehicle at a Tier 1 Rate Cap.

Many work visas qualify, including L-1, H-1B, TN, and E-3 (Australia). The two that don’t are the E-1 and E-2 visas.

It’s one of the best ways of building US credit from zero if you qualify.

On-Time Payments

If you have an apartment, a cell phone, or another utility for which you regularly make payments, set the payments on automatic.

A smooth payment history will help build your US credit from scratch

Maintaining And Improving Your Credit Score

-

- Pay your bills on time and in full.

- Keep an eye on your credit report. Each bureau offers an annual free report, giving you three reports per year.

- Keep your credit utilization low.

- As you get more credit cards, refrain from closing old ones; if you do, have a plan to avoid a hit on your score.

- Have your landlord report your rent-paying activities to the credit bureaus. There are a couple of services that do this.

- Keep the accounts active, even if you charge just one small item every couple of months.

- Be patient; it will take some time. Treat any services that offer to help you raise your scores with some suspicion.

- As you are doing this, ensure you don’t become a victim of Identity Theft

With the steps above, over a couple of months, you’ll be on your way to building US credit from scratch, which will make you credit visible.

Here is your Free eBook: How To Build US Credit From Scratch As A New Immigrant

________________________________________________

Need Help With Your US Finances?

Check out our process, which will help you evaluate our services and let you make an informed decision about working together.

Get Started Now

If you are not ready to start, that’s okay, but please stay on top of our regular updates by email or joining here. Sign Up Here.

6 Things to Do

When Starting A Job on H-1B Visa

You are starting a new job on a work visa, there are some critical things, that will set up for financial success in the first 3-6 months. Download the free guide below for the detailed list!

We never spam. By signing up you’ll also receive access to future resources right to your inbox.

Disclaimer: This article is provided for general information and illustration purposes only. Nothing contained in the material constitutes tax advice, a recommendation for the purchase or sale of any security, investment advisory services, or legal advice. I encourage you to consult a financial planner, accountant, and/or legal counsel for advice specific to your situation. Reproduction of this material is prohibited without written permission from Jane Mepham and all rights are reserved. Read the full disclaimer here.