In today’s post, I will discuss where to invest short-term money and how much should be allocated to your emergency fund.

Money you need in the next 3 years should be treated differently from money you won’t touch over the next 10 to 15 years.

I’ll also explain the tax implications of each option.

How Much Money Should You Keep In Your Emergency Fund?

Your emergency fund is a big part of your short-term money (0-3 years).

We’ll start by asking how much you should have in that bucket.

3 months

If you are single, with zero or no debt, making a reasonable income, or just starting, 3 months of your monthly expenses is a good starting point.

This money must be highly liquid and probably not “invested” anywhere.

This would also work for a dual-income couple starting as well. At some point, I want you to come back and bump it up.

6 months

You want a higher emergency fund if you are single, have a great income, and possibly support a family overseas.

Consider how long it will take to find a new job if you are let go. If it’s going to take 3 months, then plan for 6. It takes time to interview.

Also, consider your overall health, as a medical emergency can ruin you.

12 months +

If you are a dual-income couple with kids, and possibly supporting a family overseas, then you want to go with 12 months.

Also, the higher the income, the longer it will take you to find a replacement job, hence the higher number.

If you are a foreign national on a work visa, you need 12 months, plus the cost of return flights home for the whole family.

Your emergency fund also needs to include a dedicated legal bucket.

I’ve written a lot about preparing for losing your job on a work visa, and this is one way of doing it.

If you have the kind of job where you think to yourself, “If I lost this job, then I would use the break to make that long overdue visit home,” or something like a forced sabbatical, then we want more than 12 months.

If you’ve also thought that if you lost your current job, you’d probably want to start a business, plan on a bigger cushion.

If you are running your own business and are self-employed, you need 3 to 6 months of operating expenses, all based on your industry, cash flow, type of business, etc.

It’s important also to have something set aside for personal expenses – bringing the total to 12 months +.

Where to invest your short-term money depends significantly on what the money is for.

For example, if it’s the 0-3 months emergency fund – the most important thing is for it to be liquid, not the returns (interest) you’ll get on it.

Where Is The Best Place To Invest Your Short-term Money?

High-Yield Online Savings Account – Short-Term Investment

This is a savings account, housed at an online bank like Capital One or Ally Bank. NerdWallet has a list of some of the best online savings accounts.

The main difference between this and the traditional savings account is its higher interest rate.

Rates will vary, but it’s possible to find one paying around 4%, while the traditional brick and mortar banks are paying you a 0.25% rate.

Of all the options we will discuss, this is the most liquid.

A money Market Account is very similar to a high-yield online savings account.

The main difference is that it requires a higher minimum deposit and gives you an ATM card and check-writing privileges.

Interest from the account is taxed at your normal ordinary tax rate (both federal and state).

What To Look Out For?

You want one that’s FDIC insured, with no minimums, no fees, and hopefully unlimited access.

Look for banks with a checking account, as they are more likely to give you an ATM card.

A few of these, like Capital One, have started opening physical branches, so if you are interested in that, look for one with a physical branch, but it should not be a deal breaker.

If you are starting out and might want to get a credit card at some point, consider which one is more likely to give you a credit card with favourable terms.

There is something about maintaining all your financial accounts at one financial institution.

PS: But only for accounts that make sense. For example, you don’t want an IRA account at a bank.

It takes a couple of days to transfer the money from your savings account back to your checking account if going to another bank.

Some online banks will not open an account for you if you are a foreign national on a work visa. So you may have to look a little bit harder.

A Word About The FDIC Insurance And Short-Term Investments

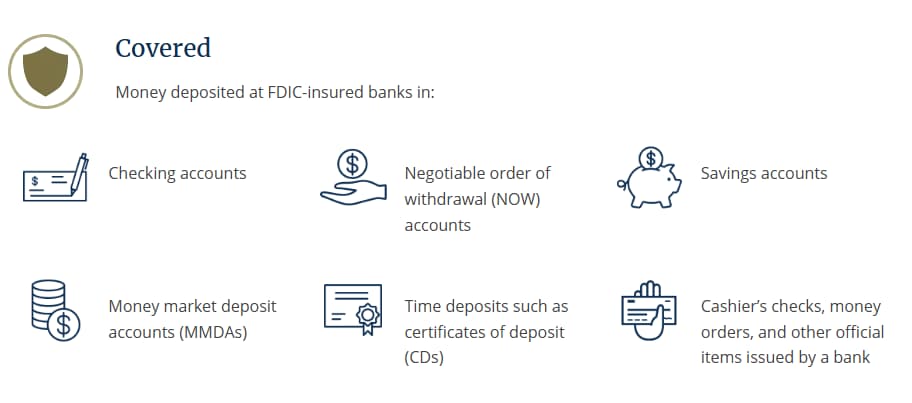

FDIC insurance covers up to $250,000 per depositor, per insured bank for each covered account type. This chart from the FDIC website shows what accounts are covered.

Certificate of Deposit (CD) For Short-Term Money

A certificate of deposit is an instrument that locks up your cash for a specific period, but pays you a fixed interest rate, often higher than a savings account.

CDs are insured by FDIC insurance, and so they are very safe. You know precisely what you will get unless you withdraw the money prematurely.

Typical terms are 3, 6, 9, 12, 24, 36 months.

They are a good option, especially for your 6-12 months emergency fund portion, assuming the first six are in a high-yield online savings account.

You can buy them via your online bank or your taxable account. For example, if you have a taxable account at Schwab, you can choose from hundreds of CDs at another bank through your account.

Depending on where you buy this from, some banks will allow you to receive interest at certain times instead of waiting until the CD matures.

One strategy that will help improve things is to build a CD ladder – so you have CDs with different maturities, like 3, 6, 9, etc, and as soon as one matures, you reinvest, which means you’ll always be invested.

The interest is taxed at your normal ordinary income tax rate.

Money Market Funds – Great Option For Short-Term Money

This is a mutual fund that invests in short-term high-quality securities, making it an excellent option for short-term money.

Examples of the securities are U.S Treasury bills, commercial paper, CDs, etc.

They aim to maintain a share price of $1. The yield is comparable to or higher than high-yield online savings accounts.

You buy the funds in a brokerage account. They are considered low risk but are not FDIC insured. But they are SIPC protected.

This means you won’t lose your money if the brokerage were to go belly-up.

SIPC limit is $500,000, which includes 250,000 cash.

The protection extends to everybody holding an account here, including US non-citizens.

It also extends to non-US citizens living outside the US.

Since these are simply mutual funds, they have an expense ratio, just like other regular funds. This is the operating expense to the fund manager.

They are considered pretty liquid, but to get your money out, you have to sell the fund, and the sale settles before the money is available to withdraw.

Typically, it happens in a day or so, so it is not a deal breaker.

Like a high-yield online savings account, their interest rate can change quickly based on the Fed rate.

What Are The Different Types Of Money Market Funds for Short-Term Money?

The type and yield are based on the underlying securities. Some are taxable, while some are tax-free, and others are state-specific.

Consider the above, your risk appetite, and your tax needs before choosing one.

Some examples, all from the Schwab money market fund lineup, based on today’s data. Other custodians, like Vanguard and Fidelity, will have similar funds.

SWTXX – Is a tax-exempt money market fund that invests in high-quality municipal instruments. Today’s seven-day yield is 3.39%.

SWKXX – Schwab California Municipal Money Fund invests in short-term California municipal securities. The current yield is 2.82%, but it’s tax-exempt from the Federal and California state taxes.

SWVXX – Schwab Value Advantage Money Fund®. Invests in high-quality, short-term money market investments issued by U.S. and foreign issuers. Its current yield is 4.18%. This is taxable.

They typically pay interest in the form of dividends every month, making them a great option for short-term investments.

How they are taxed is based on the individual fund.

US Treasury Bills For 3 Months Short-Term Money

A T-Bill is a short-term loan issued to the government. The T-bills have different durations, typically less than one year.

When you buy the T-bill, you pay the discounted price, typically the face value (the par value). At the end of the holding period, you get the face value.

The difference (your gain) is the interest you’ve earned from the government.

You can buy them on the secondary market via your taxable (brokerage) account. It’s the easiest option.

Treasury notes are intermediate-term investments that mature between 2 and 10 years (two, three, five, seven, and 10).

On the other hand, Treasury bonds mature in 20 or 30 years.

Treasury notes and Treasury bonds pay interest every six months.

The interest from all three (notes, bills, and bonds) is subject to federal taxes, but free from state taxes.

So they are great for people who live in very high tax states.

As long as you hold them to maturity, the interest rate is fixed, and since the US government guarantees them, they are considered to be at zero risk for default.

When they mature, you have to reinvest by buying more.

Short-term ETFs That Invest In T-bills

These are ETFs that invest in T-bills and other government bonds.

Two examples that come to mind are SGOV (iShares 0-3 Month Treasury Bill ETF) and VBIL (Vanguard 0-3 Month Treasury Bill ETF).

These two invest in 0-3 months T-bills. The annual yield is similar to what you get with the T-bills.

You buy them just like any other ETF. The price tends to be relatively stable.

PS: As the T-bills inside mature and pay out interest, you’ll notice the ETF price go up and come down when they pay out the dividends to you (end user).

They pay interest monthly, as the T-bills inside mature, and buy more.

The interest is taxable at the federal level but tax-free at the state and local levels. This is the same as the underlying T-bills.

The attraction is that you don’t have to wait for a particular maturity if you need the cash, but you can sell anytime. This makes them an ideal vehicle for short-term (0-3 years) money.

You have many options for your short-term money – find one that works for you and go with it.

Are You Worried About Making Mistakes With Your Investments?

Free Financial Assessment

If not ready to start, that’s okay, but please stay on top of our regular updates by email, or by joining here. Sign Up Here.

Disclaimer: This article is provided for general information and illustration purposes only. Nothing contained in the material constitutes tax advice, a recommendation for the purchase or sale of any security, investment advisory services, or legal advice. I encourage you to consult a financial planner, accountant, and/or legal counsel for advice specific to your situation. Reproduction of this material is prohibited without written permission from Jane Mepham and all rights are reserved. Read the full disclaimer here.