PURSUING THE AMERICAN DREAM ON A WORK VISA

Case Study #2

Nikesh, age 42, and Asha, age 41 (hypothetical clients*) are in the country on work visas (L-1 & H-1B) in the tech industry.

They have three kids. The two youngest are citizens (born in the US), but the oldest is on a dependent visa (born in their home country).

They read a lot about investments, but they are not sure how most of that applies to them based on their visa status.

They have applied for permanent residency, but they want to keep their options open until they have green cards.

Asha is starting a new job. Her executive compensation package includes stock options with Incentive Stock Options (ISOs), and they anticipate their income will go up considerably.

However, based on their visa status, they are not sure of the best way to manage that.

They want to save for retirement, save for their kids’ colleges, support family back at home, figure out Asha’s stock options (ISOs), and eventually buy a house. However, they are not sure what should be done first. They have been saving in different accounts, but without any direction, they wonder if what they are doing is right.

They both enjoy their careers, which is taking up a lot of their time. They would prefer to spend their free time with their kids and friends instead of figuring out what to do with their money.

In their own words – they don’t know where to start, they want to stay on the right side of the taxman, be diversified, and be good stewards of their money.

NIKESH AND ASHA’S CONCERNS AND CHALLENGES

- Are they doing the right things financially?

- Tax-efficient strategy for Asha’s new executive package, including the ISO’s.

- How to compare Asha’s new benefits with Nikesh’s, especially on medical coverage

- A new spending plan considering Asha’s new income.

- Remain alert to taxable implications.

- College planning for their kids, especially the oldest, due to the visa status.

- Competing needs, what should be addressed first?

- Doing all this while still on work visas.

ELGON’S FINANCIAL PLANNING SOLUTION

When Nikesh and Asha came calling, their main concerns were Asha’s stock options and saving for their kids’ college. They were also looking for an advisor who would keep their cultural background front and center in the advice process.

When they engaged Elgon’s financial planning services, we talked through our True Wealth Planning Process, and they began to realize that they needed to tackle other areas of their life transitions as well.

They maintain assets in their home country, and they plan to keep adding funds. In addition, they need to start thinking about their parents’ retirement plan since Nikesh is the firstborn in his family.

Advisor, Jane Mepham, put together a comprehensive plan for them and began helping them implement it on an ongoing basis, one item at a time. The following are elements included, keeping in mind their visa status:

- A cash flow (budget/spending plan), that took into consideration the family they are supporting overseas.

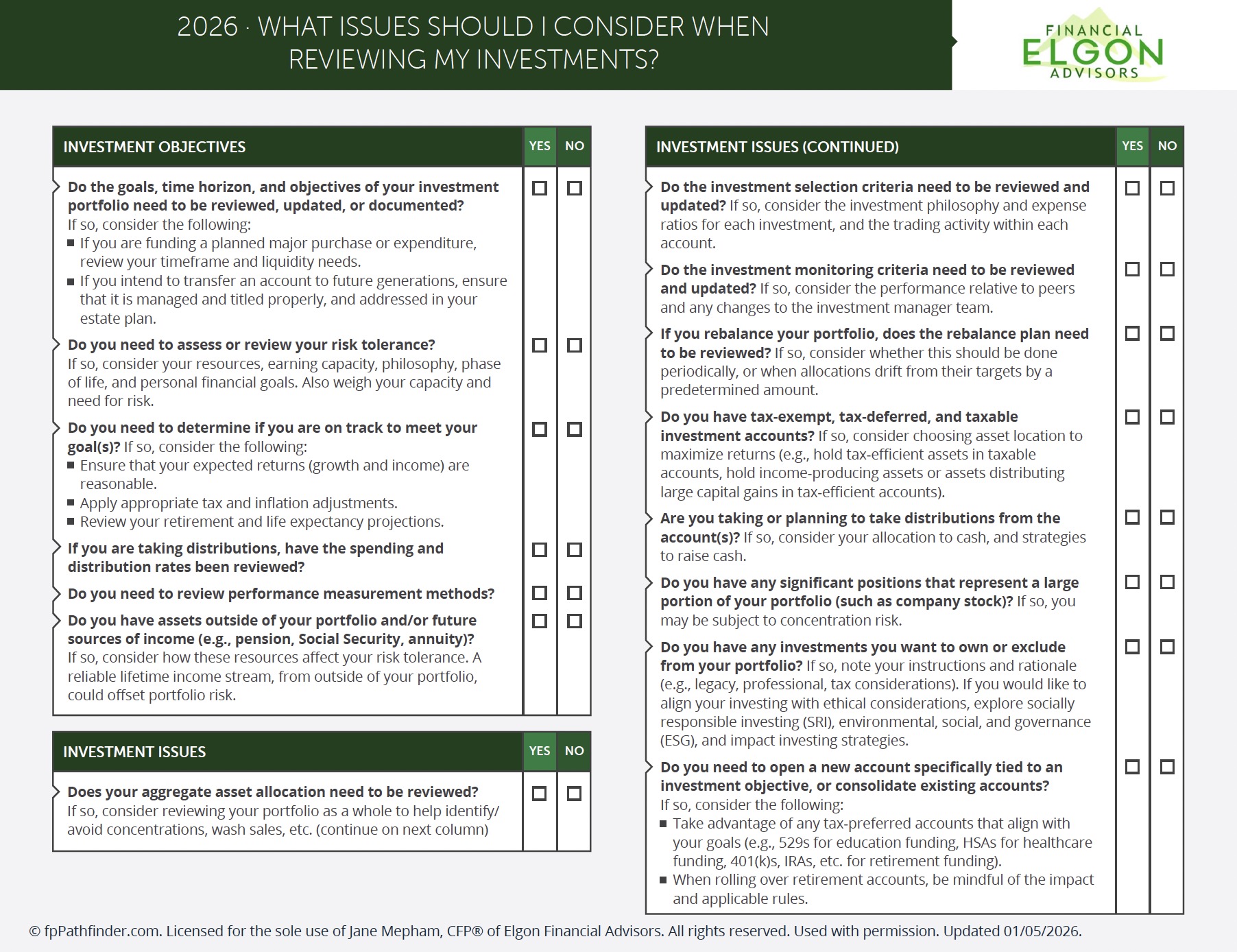

- A tax-efficient, diversified investment strategy – includes different accounts that allow them to maximize their returns.

- Education around different investment strategies and the different buckets that match.

- A flexible college funding strategy that can be used in the US or overseas.

- A plan to exercise Asha’s options systematically – considers AMT taxes and other income

- An estate plan that takes into consideration their non-citizenship status.

- A tax review with an international CPA that understands FBAR filings and other cross-border implications.

- Put the right insurance policies in place.

- Access to the personal dashboard which provides a snapshot of their financial lives in one spot and at any one point. It also helps them stay organized.

They report being in a better place emotionally knowing that they have a clear financial roadmap that can be adjusted as their lives change.

They are enjoying more time with their kids and friends, with the confidence of knowing they are building generational wealth for their family.

________________________________________________________________

*DISCLOSURE STATEMENT

The above success stories are based on hypothetical clients. The information is provided for general information and illustration purposes only. Your use of the information is at your sole risk. Elgon Financial Advisors and advisor Jane Mepham, CFP® do not give direct tax or legal advice. Referrals to other professionals like CPA’s, Estate Planning and Immigration Attorneys are available upon request. Investment advice is provided on assets held in the US exclusively.

Ready to Pursue Your American Dream?

If you're not ready, that's okay, sign up for our Regular Updates: