One of the worst investment decisions I recall making was buying a stock at close to $100 per share and watching it go down to a single-digit number. Does anybody recall Qualcomm in 1999 – 2021?. This was my shocking introduction to anchoring bias in investing in hindsight.

I’m fascinated by behavioral science which at a high level looks at the subject of human actions. It tries to answer the question of why people do certain things. (1)

When I made the decision to buy the stock, I did not look at the data or the fundamentals, but I convinced myself it was a good buy and the price was right. In hindsight, the price that day was my anchor price. Everybody was buying the stock; it was on the news and I did not want to miss out (FOMO?).

In hindsight, and with the knowledge, I now have, I realize this was a classic example of anchoring bias. Let me explain.

Initial Info and Anchoring Bias

In behavioral science, we use different concepts to make decisions, and one of these is anchoring. It’s the idea of using an irrational bias towards some benchmark number, that may not be rooted in facts.

We rely too much on the initial information we find when making decisions.

Here is a classic example; you go to the market and stop at a stall where they are selling baskets for $600 apiece. If the next guy is selling the same at $300, you’ll walk away thinking he is cheaper, and you might even buy it. The $600 is your anchor point.

On the other hand, if you’d seen the $300 one first, you may not have thought that it was cheap.

Pre-existing Information and Anchoring Bias

Another option is to rely on pre-existing information, regardless of the current situation.

The last time you went on vacation a couple of years ago, you were able to rent a place for $180 a night. You look at it today and the going rate is now $300 dollars. You decide it’s too expensive even though it could be a great deal. In your mind, it’s now too expensive, as it should still be $180 – your anchor price.

This is how it works

We see information (today or in the past) and save it as the truth.

We make future decisions based on that without considering what’s the actual or the intrinsic value of the item in question.

Anchoring is a trick marketers use all the time. They list something at a certain price and then give you a discount, which in your mind makes the item cheaper and so more valuable.

Anchoring Bias in the Stock Market Today

There are a couple of examples in the stock market, where the investor anchors on a price and ends up missing what could have been a great buy or ends up losing.

In the stock market, investors will look at a stock or a mutual fund, and because it did well in the past, they expect the same returns. They do this without looking at any data.

Another version of this is where they try and predict what the future price is going to be, simply by looking at today’s price. Based on what’s happening, today’s price may not be the actual value of the stock.

Consider a case where an investor refuses to sell an investment that’s going down. In their minds, they paid a certain price for it and believe (anchored) that is the value. They ignore other factors that could cause the price to change (2)

Real Estate and Anchoring Bias

We see the same thing with real estate. You pay a certain price for a property, and in your mind, you convince yourself you’ll never sell unless you hit that number or higher.

I completely understand that no one wants to sell at a loss, but it’s important to consider what you are basing the selling price on.

The bottom line is anchoring bias will cause you to make bad investment decisions.

Overcoming Anchoring Bias for Successful Investing

We use anchoring bias, as it gives us mental shortcuts to the many decisions we must make in life. The following are ways that may help us overcome this and by default allow us to make investment decisions based on facts.

Acknowledge bias and question your decisions when you make them. Challenge yourself to figure out why you are making a particular decision.

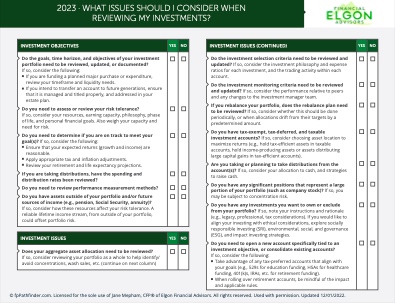

Don’t make impulsive buy-sell investing decisions. Have an objective practical process for evaluating everything first. A checklist works wonders here. (3)

Before making an investment decision, thoroughly research the equity in question (especially if it’s a single stock), and study all the data available about that equity. If not, sure you want to do this, then go with a broad market index. (4)

Have somebody else vet your decisions. A financial advisor can help you with this. They’ll help you analyze your risk profile, create the right investment mix, and more importantly help you decide ahead of time when you’ll want to get out of the market.

The stock market can be a wonderful place to create wealth and help you work towards achieving your American dream, but it helps to have a plan.

Need Help?

The stock market is not for the faint-hearted, especially now. We are here to assist you in any way we can. Click here if you’d like to set up a meeting and chat on the above topic or any other financial issues that affect foreign-born families in the US.

To stay on top of Elgon’s blog posts by email, please sign up here.

Sources

(1) https://www.optimizely.com/optimization-glossary/behavioral-science

(2) https://www.managementstudyguide.com/anchoring-bias-in-behavioural-finance.htm

(3) https://www.financialexpress.com/money/equity-investing-how-to-avoid-anchoring-bias-when-investing/2223428/

(4) https://www.investopedia.com/terms/a/anchoring.asp

Disclaimer: This article is provided for general information and illustration purposes only. Nothing contained in the material constitutes tax advice, a recommendation for the purchase or sale of any security, investment advisory services, or legal advice. I encourage you to consult a financial planner, accountant, and/or legal counsel for advice specific to your situation. Reproduction of this material is prohibited without written permission from Jane Mepham and all rights are reserved. Read the full disclaimer here.