In today’s post, we dive into FIRE on a work visa. I’m answering the question, how do you do you plan to do FIRE while on a work visa?

Andre Nader who helps FAANG Tech Workers FIRE, asked me a very specific question on the subject. I quote:-

“I want your thoughts on how the strategy of Early Retirement planning might look different for FAANG workers in the US on work visas, specifically for those from India, China, Canada, the UK, Russia, Brazil, and other countries looking to retire in the next 10 years around the age of 40.”

The following post is my answer to Andre’s question.

How To FIRE While On A Work Visa

FIRE – Financial Independence, Retire Early Movement advocates for saving aggressively, allowing for early retirement.

Doing FIRE on a work visa can be extremely complicated and challenging.

I’m going to address the challenges that are likely to stand in your way and provide some solutions, but more importantly, give you some ideas for thinking through the issues.

I’ll use the parameters you’ve provided “Retire in about 10 years around age 40 outside the U.S.”.

The challenges these folks face are very similar to the same issues I addressed in my Kitces article on Investing On Work Visas In The US and are very nuanced by what country they call home and the type of visa they are on.

The time horizon also makes this challenging.

Challenges You’ll Face As You Pursue FIRE On A Work Visa

As you embark on your FIRE journey on a work visa, you are likely to hit the following issues. My goal is to try and give you possible solutions to these challenges.

Before you embark on them, please get specific legal, tax, and financial advice, as everybody’s situation is different.

A summary of the issues you are likely to face that US citizens do not face.

Future-use accounts

Tax treaty limitations

Visa limitations

Investment types

Brokerage firms

FIRE On Work Visa – Future-use Accounts

I discussed this one extensively in my two articles, the Kitces article referenced at the start and If On A Work Visa Should I Invest In The 401k?

It comes down to this, what we think of as ‘FIRE accounts” are “future-use accounts” designed to be used in the US.

A big component of the account working right is being left alone to grow for a long time. Taking money out prematurely if moving overseas leads to tax penalties.

Tax Treaty Limitations

Most countries with tax treaties with the US don’t recognize the tax-free nature of certain retirement accounts (e.g., Roth IRAs, Roth 401(k) plan accounts, and HSAs).

They treat these accounts like regular foreign brokerage accounts, and so end up charging taxes on the gains.

Brazil (one of the countries on your list) does not have a tax treaty with the US. The other countries on the list do.

Work Visa Limitations

Work visas have a limitation since they are temporary.

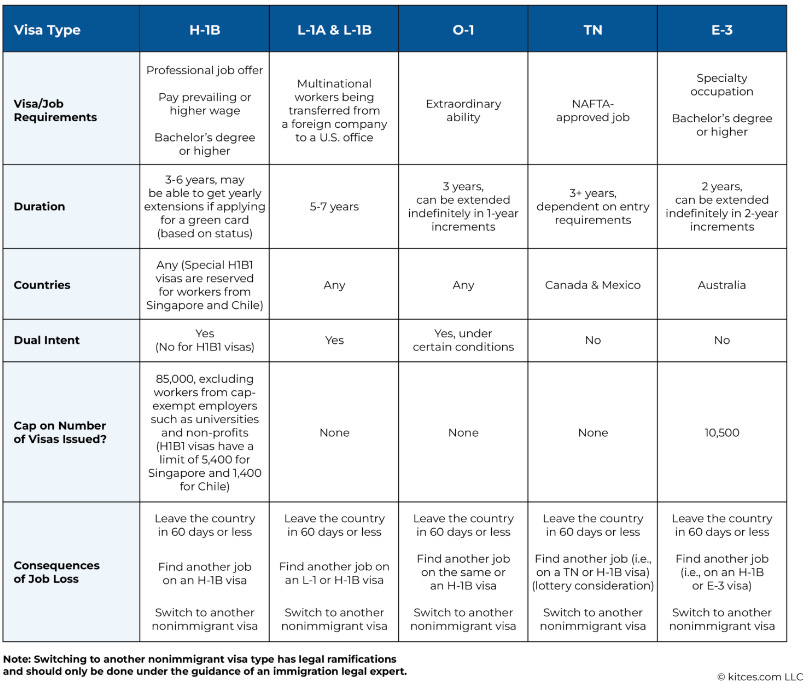

Most of the foreign-born FAANG employees are on H-1B, L-1, E-3, or 0-1 visas.

The H-1B visa can be extended once for a total of 6 years. O-1 and E-3 can be extended in 1 or 2-year increments, but the candidate must meet certain requirements. See the details about the visas below.

Image Credit, Kitces.com

In addition, if you get fired or lose your job, you have to leave the country in 60 days or less if you are not able to find a new position.

Investments

EU residents are prohibited from investing in certain US EFTs due to MiFID 2 regulations. So, if leaving the US assets invested in the market, you need to ensure this is not an issue.

Brokerage (Custodian) Challenges

As I previously discussed, there are a lot of US-based brokerage firms that won’t open accounts for non-US citizens on work visas.

A few of the ones that agree to open the accounts will close them immediately once the owner leaves the US and has a foreign address.

FIRE On Work Visa – Getting Around The Challenges

Retirement Plan Accounts – Pre-tax Accounts And Tax Treaties

Max out your traditional pre-tax retirement accounts and get the full match.

This needs to be money you know for sure you are going to leave alone for a long time. Unless there is a reason to take the amount out, I suggest leaving it alone, at least until 59.5.

It’s also important to find the right home for it. Confirm if your company’s custodian is going to be okay with you leaving the money there.

If not, find another custodian (brokerage firm) and do a rollover to an IRA.

With a foreign address, you’ll be subject to a 30% withholding if taken out after 59.5. This assumes you are not a US tax resident.

The withholding is modified by the tax treaty if available, which is why it’s important to understand the technical details of the treaty if available.

I can’t stress enough the need to talk to a professional about this when you get to it.

Here is an example of an article dissecting the nuances of the tax treaty with respect to India on retirement plans and showing how an Indian citizen may be able to avoid the penalty.

Retirement Plans Accounts – Roth-type Accounts and Tax Treaties

If you are moving to a country that does not call out the Roth account in the tax treaty with the US, assume the account is most likely going to be taxed on the distributions by your home country.

As an example, the UK treaty article 17th states that if a pension plan is tax-free in one jurisdiction, then it’s tax-free in another state. Applying it to this situation has been interpreted to mean since Roth is Tax-free in the US, then it’s free in the UK.

Other countries on this list are Estonia, France, Belgium, Malta, Latvia, Lithuania, and Canada.

If from one of those countries, the Roth is an attractive option. With every one of these, there are some nuances, before you leave the account behind, to take into consideration.

Takeaway: If your country is not on the list – consider skipping the Roth. If the country is on the list, dig a little deeper into what happens before you leave, and also what happens once you are immediately in your home country, as well when ready to withdraw the money.

Brokerage Account As A Possible Solution

If using the Roth-type of account is not ideal, invest everything you can into a taxable brokerage account. It’s actually one of the best options for foreign nationals in the US.

If living outside the US, and you are not a US tax resident, then you pay 0 US tax on capital gains. Keep in mind that your home country might tax you on the gains.

If there are any dividends the typical 30% withholding will apply on the US side, which will be modified (lowered) by the tax treaty if available.

Takeaway: Use the taxable account, but invest in ETFs that are tax-efficient, minimizing dividends.

529 College Plan

If you are leaving the country in about 10 years, and your kids were not born in the US, and you are not pursuing a green card, skip the 529, and stick with the taxable account.

If your kids were born in the US, and there is a chance you might want to send them back to the US for education, then the 529 plan is a possibility, but prioritize the taxable account and analyze your situation thoroughly.

Getting Around The Visa Limitations

If not pursuing the green card process, figure out how to increase your income, so you have more money going into the taxable account.

This is especially important for visas (H-1B, L-1, etc.), that cannot be extended indefinitely.

A couple of ideas

Switch jobs (be careful with the visa issues)

Get more training in your field (to command a higher income).

If your spouse can work, have them get a job.

In this post, I address things you can do to prepare for a layoff – a lot of them are designed to ensure no financial hurt, and also increase your income by increasing your skill set.

One thing you are not able to do is get a side hustle on the work visa, as you are strictly limited to one employer. But you can get passive income, but not employment. Be very careful as it’s very easy to cross the line.

Getting Around The Visa Situation – Pursuing The Green Card

Pursuing a green card can buy you time, even if you never get it. If your priority date is far, it could mean being on hold for years, but not having to deal with the visa expiring.

For example, when I checked India’s priority date a few months ago it was April 2011. This means somebody applying for a green card now from India, is not likely to get it for another 15 + years.

Challenges That Come If You Get The Green Card Before Leaving The US

If you are from a country with a shorter queue (anywhere from 1 to 10 years), there is a chance you’ll be able to get a green card before you leave.

You are likely to deal with these challenges, but there is a way to overcome them.

You’ll always be a US tax resident with worldwide tax reporting obligations and you’ll always have a need to be tax compliant. If you end up working outside the US or running a business, there will be tax consequences.

Foreign-earned income exclusion and foreign tax credits will allow you to mitigate the situation. For a lot of people, it just ends up as being a lot of paperwork. Keep in mind though, if you are outside the US for more than a year without special permission, you could lose your immigration residency, but not your tax residency.

You have to be extremely careful not to invest in what are deemed PFICs (Passive Foreign Investment Companies), once outside the US due to the complicated process of filing taxes for them. PFICs include foreign mutual funds registered outside the US. The issue with owning a PFIC is the punitive taxation on them and the very time-consuming process of reporting them every year.

If you have been investing in your home country’s pension plan, ensure that the investments within the plan are not deemed PFIC – due to the above issue.

If you decide to abandon your green card or US citizenship, be careful not to be considered a covered expatriate. A covered expatriate – A US citizen or a green card holder who’s lived in the US for 8 out of any 15-year period). The process of leaving is called expatriation. It involves what’s likely to be a high exit tax if the covered expatriate has a net worth of at least $2 million dollars.

One advantage of getting the green card and being outside is you can withdraw your retirement money and not pay taxes. You do this by doing periodic lump sum withdrawals, small enough to not trigger taxes. They’ll still withhold at 20%, but you can get this back when you file your annual taxes.

Brokerage Firms Challenge Possible Solutions

There are two brokerages that I have found to be welcoming to those on visas. They allow retail accounts (So you don’t have to go through an advisor). They also don’t have an issue with foreign addresses.

The two are Charles Schwab and Interactive Brokers.

Social Security

As long as you’ve worked for 10 years (40 quarters), and you’ve been paying your taxes faithfully, you are entitled to get social security, regardless of where you end up.

As you plan your time – keep that in mind, and ideally make sure you get to 40 quarters.

Conclusion

It’s possible to be a part of the FIRE movement on a work visa, you just have to be willing to be flexible.

Follow Up Question from Andre: “For the case where there isn’t a tax treaty; the Roth account would be treated by the Foreign country as a normal brokerage and subject to normal taxes on gains. Would the Roth account also be subject to early withdrawal penalties from the US?

I want to understand prioritizing Roth vs Taxable since many will want to understand whether to contribute to their after-tax or taxable accounts and may not be sure where they are going to retire.

I understand the Roth will get treated as a normal account by the foreign country which would make it not desirable, but wondering if it would actually be worse?”

Jane: For the case where there isn’t a tax treaty; the Roth account would be treated by the foreign country as a normal brokerage and subject to normal taxes on gains. Would it also be subject to early withdrawal penalties from the US? – yes to US penalties, the outside taxation depends on the country and how they tax outside accounts.

Some will tax it on earnings, some may consider the withdrawal as income…good records will help, which in a Roth account, the US is not too bothered, because of the nature of the account, but can find them if need be.

Taxable – 0 US taxes on capital gains, but the US will withhold 30% on dividends, which can be modified by a tax treaty. Not sure what the other country will do – again depends on how they treat outside investment accounts.

Overall, I think you get more flexibility with the taxable account, especially if you are likely going to need that money before 59.5.

It’s a real minefield – hence lots of disclaimers about talking to professionals.

First published here:- Fire Planning on Work Visa

Need Help With Your US Finances?

Check out our process that will help you evaluate our services, and let you make an informed decision about working together.

Get Started Now

If not ready to start, that’s okay, but please stay on top of our regular updates by email, or by joining here. Sign Up Here

6 Things to Do

When Starting A Job on H-1B Visa

You are starting a new job on a work visa, there are some critical things, that will set up for financial success in the first 3-6 months. Download the free guide below for the detailed list!

We never spam. By signing up you’ll also receive access to future resources right to your inbox.

Disclaimer: This article is provided for general information and illustration purposes only. Nothing contained in the material constitutes tax advice, a recommendation for the purchase or sale of any security, investment advisory services, or legal advice. I encourage you to consult a financial planner, accountant, and/or legal counsel for advice specific to your situation. Reproduction of this material is prohibited without written permission from Jane Mepham and all rights are reserved. Read the full disclaimer here.