Identity theft – How to not be a victim. In this post, I’m sharing a list of things to do to protect your data and avoid identity theft or avoid having your money stolen.

I’m also sharing a brand-new checklist to help you determine if you’re at risk of having your identity stolen.

In the last couple of weeks, you’ve probably read about the massive data breach that released the personal information records of 2.9 billion people from the National Public Data. The data includes data from the US, Canada, and the UK.

It contains the person’s full name, address, social security, phone number, and alternate names.

Identity Theft – Why You Should Be Concerned About Becoming A Victim

If your personal info lands in the wrong hands, here are some of the things they may try to do, according to the same article

- Take over your investment accounts – banks, social security, insurance policies, etc.

- Open new accounts in your name

- File fraudulent tax returns with your SS, etc.

You’ve probably heard of horror stories where it takes victims years to get out of an identity theft crisis, not to mention other impacts on their lives.

With all the recent data breaches over the last few years, the best approach is to assume that your information is already out there. Your goal is to ensure that nobody misuses your data.

How To Not Be An Identity Theft Victim – Even If Your Data Is Out

The following is a list of things you can do to protect yourself. I have gone through most of them, so it includes some caveats. Don’t become a victim by ignoring any of them.

Place Fraud Alerts On Your Credit To Stop Identity Theft

A fraud alert tells a potential creditor that they need to check in with you before extending credit. Anybody or company trying to extend some credit must check in with you.

You can call the credit agency or do it online on each agency’s website.

The following links will take you to the agency’s fraud alert page.

The three agencies are Experian, Equifax, and Transunion.

You only need to place an alert on one agency’s website, which will then be forwarded to the other two sites.

The initial alert is good for one year. You are also removed from pre-screened credit and insurance offers for six months.

An extended alert: If your identity has been stolen, you can place an extended alert that lasts seven years. To qualify, you’ll need a police report or an FTC Identity Theft Report from IdentifyTheft.gov.

Active-Duty Alert: For those on active duty, the alert lasts for two years

For most people, the annual alert will suffice.

What To Do After Placing The Alert

Create a calendar reminder to come back and update this after one year.

As part of the service, they’ll offer you a free credit report (you are entitled to one anyway), download a copy, check for any issues, and deal with them.

Place A Credit Freeze On Your Credit To Stop Identity Theft

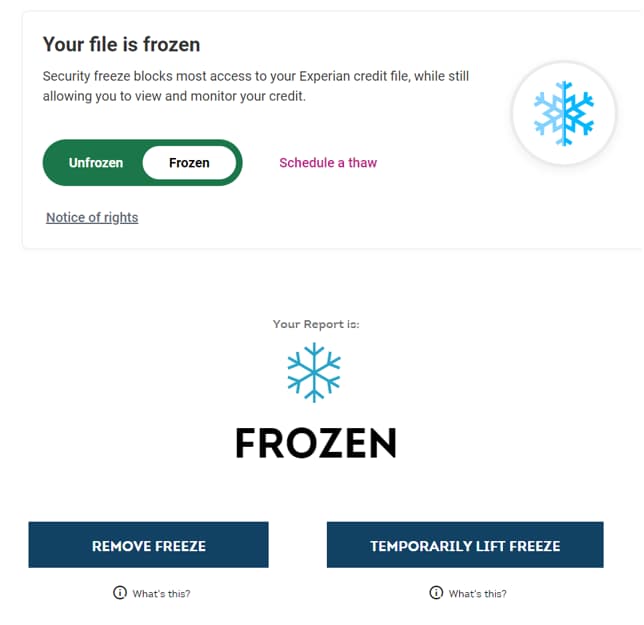

A credit freeze, or a security freeze, is the best way to help prevent new accounts from being opened in your name. It’s free to freeze, unfreeze, and temporarily lift a freeze on your credit, and it won’t affect your credit score.

This must be done individually on each site. Once again, be careful not to sign up for extra services.

You can create an account online or over the phone, but online is preferred. Use the following links to freeze your credit.

Transunion, Experian, and Equifax

Example Of Placing An Alert And A Freeze On Transunion

The process is the same for the other agencies, but the security questions may differ slightly. Here is the process I went through.

- Created the account

- Used phone number to verify

- Used email verification

- Dashboard

- Place a fraud alert on your credit – provide them a phone number – An alert means whoever is inquiring needs to verify with you before extending credit or opening an account.

- Since it’s the initial alert – it will also get placed with the other agencies, Experian and Equifax.

- The alert is for one year.

- Place a fraud alert on your credit – provide them a phone number – An alert means whoever is inquiring needs to verify with you before extending credit or opening an account.

- Place a freeze – on the same dashboard

- Unlike the alert, This must be done on each agency’s website.

- They offered the credit report – which I accepted

- It will be shown on the screen, so plan to download a pdf copy

- It omits the credit score; some agencies may include it.

- Place a freeze – on the same dashboard

Here Is What It Looks Like On Experian

Watch Out For The Following

I noticed all the companies are trying to sell you something extra, such as a Transunion credit lock.

A credit lock is a paid credit monitoring service and should not be confused with a credit freeze. Be careful whenever any of the sites ask for credit card information or to try something out for a couple of days.

You may need the monitoring at some point, but it should be under your own terms.

Experian will try to sell you ID Theft Protection via the Experian IdentityWorks Premium.

I also noticed that Experian had somehow opted me into various credit card offers, loans, etc.

This means I started getting a marketing email almost every day with some offers. I would have to unfreeze my credit to apply for those offers, which defeats the purpose.

The solution is to unsubscribe from all kinds of marketing emails.

Keep monitoring your credit report – you can get reports from the official site Annual Credit Report.

Alerts And Freezes For Your Family

If married, encourage your spouse to do the same thing, especially if you share accounts.

If your kids are over 18, get them to go through the same process. If they are working and earning below the standard deduction threshold, they tend not to file taxes.

However, filing taxes is one way of ensuring that nobody uses their social security number or finding out if somebody has.

If the kids are below 18, you can freeze their credit on their behalf. This Equifax FQA answers a lot of questions on handling this for your child.

Please note: If you have questions about building or improving your credit scores, check out this blog post, ” How To Build US Credit Score From Zero”

Other Things To Do To Protect Yourself Online

Password Manager

A password manager is software that saves all your passwords so you don’t have to remember them when logging into different accounts. Two issues with passwords that the password manager will solve are

Simple passwords that are easy to remember

Reusing the same password on every single site

The manager can be set to generate random passwords for you, so no two sites will have the same password. A good one will also scan your database and let you know if you have weak or reused passwords.

You need a super strong master password, which is the only thing you need to remember. A good password manager will cost about $60 per year, and most will work on your laptop and phone. Examples are Dashlane, Bitwarden, Nordpass, etc.

While you are here, change all passwords and plan to change them every quarter – it’s a pain, but it’s better than dealing with your information in the wrong hands.

2FA Authentication

In addition to having the password manager, you should enable 2FA authentication on all your accounts, especially your financial accounts.

This means you need two forms of authentication before you can log into a system: the password and a one-time code generated by an authenticated app or sent to a phone number.

Schwab, where we custody your money if you work with Elgon, will allow you to set up a verbal password on your account. This extra layer ensures that you are genuinely the one logging in, even if your information has been stolen.

Financial Accounts – Don’t Be A Victim

Email Address

I recommend setting up a new email address to be used only for your financial accounts (banks, brokerage, etc.). The recent AT and T Breach exposed data, including personal emails. You’ll need to update all your accounts to the new address.

In the meantime, if you receive funny-looking emails or emails that seem a little off, don’t click on them; instead, send them to your delete folder. Play it safe. Be cautious and vigilant at all times.

Monitor Accounts Activities

Set up alerts to be notified when certain transactions occur in your bank and brokerage accounts, such as withdrawals above a certain amount or weekly balances.

This will ensure that if something is off, you’ll get ahead of the situation, and being automated also means it’s less work for you.

Phone Number Account Pin

Set up a PIN with the phone company, so if anyone wants to port your number out, they cannot do so without that PIN.

While you are here, if you get calls from numbers you don’t recognize – don’t answer the phone or go ahead and block them.

Create A Social Security Account

Create an account on login.gov. You can see your social security estimated payments, history, etc., and it also ensures that nobody else can claim that account.

Create an IP PIN To Stop Others Filing Taxes With Your SSN

I am concerned that many people will not discover their data has been compromised until next year when they file taxes and find somebody else already did.

The only way to stop this is to create an account with the IRS and get an IP PIN to file your taxes. They’ll send you a new pin every year. IP PIN stands for identity protection personal identification number.

Create an online account on the IRS website. From here, you can request an IP PIN to fraudulently prevent people from filing taxes using your social security number. You’ll get a new pion every year that you’ll use to file your taxes.

Leaving The Country – Protect Your Identity

If you are leaving the country to move abroad, protect your identity by following the above steps. It’s easy to get your identity stolen and not realize it. Avoid identity theft: Don’t be a victim by following the above steps.

Conclusion

I’ll keep updating this post with more ideas as I implement them, but in the meantime, be diligent and never let your guard down.

________________________________________________

Need Help With Your US Finances?

Check out our process, which will help you evaluate our services and let you make an informed decision about working together.

Get Started Now

If you are not ready to start, that’s okay, but please stay on top of our regular updates by email or joining here. Sign Up Here.

6 Things to Do

When Starting A Job on H-1B Visa

You are starting a new job on a work visa, there are some critical things, that will set up for financial success in the first 3-6 months. Download the free guide below for the detailed list!

We never spam. By signing up you’ll also receive access to future resources right to your inbox.

Disclaimer: This article is provided for general information and illustration purposes only. Nothing contained in the material constitutes tax advice, a recommendation for the purchase or sale of any security, investment advisory services, or legal advice. I encourage you to consult a financial planner, accountant, and/or legal counsel for advice specific to your situation. Reproduction of this material is prohibited without written permission from Jane Mepham and all rights are reserved. Read the full disclaimer here.