Should I create a trust? It seems to be the number one question that arises when estate planning is discussed.

There is a lot of advice available that suggests everyone should create a trust, including individuals on work visas.

This is generic advice; it does not take into consideration your specific legal status, the state in which you reside, and the reason you want to create the trust. To answer the question, “Should I create a trust, especially on a work visa?”, let’s start by understanding trusts.

What’s A Trust?

A trust is a legal entity, similar to an individual, with distinct rights and privileges. Because it’s a separate entity, just like you, it can own properties and dictate how those properties are governed.

The following elements are critical to the existence of a trust.

Who Is The Grantor / Trustor / Settlor?

This is the person who creates the trust and places assets into it. It leads to some trusts being referred to as grantor trusts. Once the grantor passes, you are likely to hear of non-grantor trusts.

Who Can Be The Trustee?

The trustee is the person or organization responsible for managing the trust assets for the benefit of the beneficiary.

They have a fiduciary duty to manage the assets, meaning that everything must be done in the best interest of the beneficiary. For most simple trusts, the grantor and the trustee are the same person.

Who Can Be The Beneficiary?

A trust beneficiary is the individual/s or organization that’s designated to receive the benefits, that is income, assets, or other benefits called out in the trust. A beneficiary can be a non-US citizen (visa holder or green card holder) or a non-US resident; however, additional work will be required to manage the trust in this case.

Trust Document (Instrument)

Whenever someone says they have a trust, it’s crucial to review the details of the trust document or also known as the trust instrument.

It outlines how the assets are to be managed, including any co-trustees, specifies when and how to dissolve the trust, and provides the names of successor beneficiaries and trustees, as well as all other details that comprise the trust.

It’s probably the most critical aspect of trust.

The Trust Jurisdiction

The Jurisdiction is the location where the trust is “physically located”. It defines the governing laws and regulations that will impact taxes, asset protection, and other related matters.

The goal is to ensure that the law governing the trust aligns with the grantor’s desires and wishes.

The location can be in the US or an international destination. For example, states like Nevada and Delaware are popular destinations for asset protection in the US, while the Cook Islands are renowned for their privacy.

Regardless of where the trust is established, the one thing you don’t want to do is have it considered a “Foreign Trust” – for the reasons stated below. You want it to be a domestic trust, unless there are other special considerations, which are best addressed by a cross-border estate lawyer.

It’s essential that, as a foreign national, you understand what happens to the trust’s jurisdiction when you move to another country.

Some countries view US trusts as being very opaque, which is likely not what you had in mind, leading to a potential taxation nightmare. France is notorious for this.

Considerations For Foreign Nationals On Work Visas

A foreign national can be the grantor, trustee, or beneficiary, subject to certain considerations.

If you are serving as the trustee, and you leave the country, the trust may become a foreign trust, rather than a domestic trust, which is not favorable from a tax perspective, as it creates additional reporting requirements.

You also lose a lot of the benefits of creating the trust in the first place.

Many lawyers will advise against having a non-citizen, non-resident serve as a co-trustee or successor trustee. The goal is to maintain it as a domestic trust while still getting the benefits of the trust. There are ways of getting around this.

What Makes A Trust A Domestic Trust

To be a domestic trust, the trust must pass these two tests

The Court Case – A US court must supervise the Trust.

The Control Test – The person controlling the trust (the trustee) must be a US person.

Lawyers will advise using specific language in the trust (see above under ‘trust document’) to ensure the trust does not inadvertently become a foreign trust.

The Types Of Trusts

There are various ways to classify trusts, based on complexity, creation, purpose, tax rules, and other factors; however, for the purposes of this post, I’ll focus on two broad categories. Revocable and irrevocable.

Revocable Living Trust

The grantor creates it to provide privacy and avoid the probate process. Probate is the legal process by which the courts administer a will after you die.

The process ensures that your beneficiaries receive what’s due to them after paying off any debts owed by the estate.

What Are The Advantages Of a Revocable Living Trust?

Avoids probate – The problem with probate is that it can take a considerable amount of time and be very expensive. For example, in California, the process can take up to two years and cost thousands of dollars to complete. In the example provided, probate can cost up to $12,000 for an estate worth approximately $170,000.

Privacy – Avoiding probate means maintaining your privacy of what’s in the estate, and who it’s going to. This is unlike a will.

Flexibility – The trust can be modified at any point to fit the changing needs of the grantor.

Disability planning – If the grantor becomes incapacitated, the successor trustee can continue managing the trust assets.

Step-up in basis – The heirs will get a step-up in basis of any property they inherit in the trust.

What Are The Disadvantages Of A Revocable Trust?

No credit protection – This type of trust does not provide any protection, since the grantor still owns the assets.

Expensive to set up – It’s costly to set up compared to a simple will.

Issues refinancing – If you put a house in the trust, future refinancing can be challenging, forcing you to remove it from the trust. If there is a mortgage on the house, some lenders will have issues with it. You also have to have a new deed issued and recorded.

Funding The Trust

Once created, the trust needs to be funded. Funding is moving or titling assets in the trust’s name.

Failing to fund the trust is probably one of the biggest mistakes I see people making with this kind of trust.

Because the revocable living trust is considered a grantor trust, any income is still attributed to you, so there is no income tax benefit to creating this type of trust.

Any assets with named beneficiaries, like your retirement accounts, don’t need to be in the trust, as they will pass on to beneficiaries outside of the probate process.

The trust can be changed at any time; however, upon the death of the grantor, it becomes irrevocable.

The Irrevocable Trust

A revocable trust is typically used to mitigate high estate taxes if the size of the estate exceeds the federal estate tax exemption – in 2025, this number is $ 15 million. Some states have lower numbers or none at all; for example, Washington state’s number is $3 million in 2025.

Once created, generally, a trust cannot be changed or terminated by the grantor. Additionally, once assets are transferred into the trust, they cannot be removed, and the grantor loses complete ownership.

Assets transferred to the trust are considered a complete gift; therefore, if they exceed the annual limit ($19,000 in 2025), the grantor must file a Form 709 gift tax return. The amount gifted uses the grantor’s lifetime exemption.

Irrevocable trusts are great for the following.

What Are The Advantages / Benefits Of An Irrevocable Trust?

Reducing estate taxes – Assets moved into the trust are no longer considered to be a part of your estate, so potentially lowering how much estate tax you’d end up paying in the future.

Asset protection – They can protect assets from lawsuits or potential creditors, as the grantor no longer owns those assets.

What Are The Disadvantages Of An Irrevocable Trust?

Loss of asset control – This is a feature of the trust, so it’s essential to understand that you, as the grantor, lose control of the assets you put into the trust.

Complex – These trusts are complex to establish and manage. They require ongoing administration.

Tax filing and administration – Whenever the trust generates income or makes a distribution, taxes must be filed, which will include K-1 forms. Therefore, it incurs additional costs, in addition to managing the assets, as the grantor is typically not the trustee.

No Step-Up in basis – Step-up in basis lowers future capital gains on an asset. For example, if you inherit an asset today worth $300,000 that was initially purchased for $100,000, your new cost basis is $300,000. If the asset is placed in the trust, you lose that step-up at inheritance.

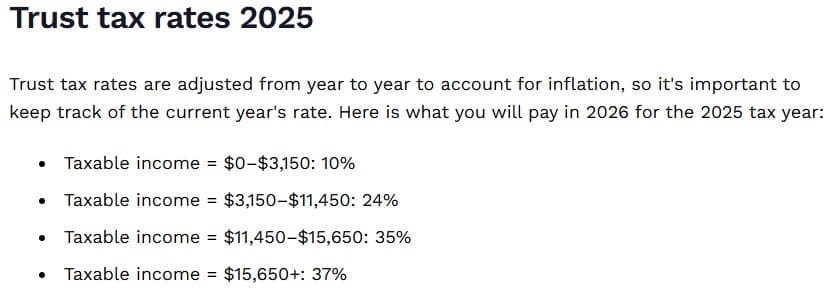

Tax implications – If the trust holds income-generating assets, it is subject to very high tax rates – see below.

From legalZoom

Other Specialized Trusts

There are a few other specialized trusts, typically irrevocable, established for specific purposes (such as special needs planning, charitable giving, or asset protection). Some examples.

Special Needs Trust (SNT)

This trust enables individuals with disabilities to receive financial support while remaining eligible for government benefits, such as Medicaid and Supplemental Security Income.

The extra funds will allow them to get specialized therapies, education, and other needs, while keeping their assets or income limits at the level that allows them to get the government benefits.

It’s essential to manage it carefully to avoid losing the benefits.

Testamentary Trust

This trust is created through a will and therefore only becomes effective upon the grantor’s passing.

It offers no privacy since it’s created after the entire probate process has been completed.

The primary reason for creating this type of trust is when the beneficiaries are minors or the grantor wishes to impose restrictions on specific assets or the manner of their inheritance.

It’s expensive to maintain, as the court is involved until the trust terminates.

Irrevocable Life Insurance Trust (ILIT)

It’s one of the best options for managing estate taxes. The trust is created to own and control life insurance policy on the insured when alive.

The death benefit remains outside the estate and is therefore not taxable, and it can be used to pay estate taxes at the end.

The grantor (insured) must maintain a strict separation of assets owned by the insured versus those owned by the trust, including checking accounts used to pay premiums.

If done right, it’s one of the best methods of passing on generational wealth, as it can be used to skip a generation and gift to grandchildren.

ILIT And The $60,000 Exemption

An ILIT is one of the best ways of dealing with the dismal estate tax exemption granted to NRAs with US-situs assets.

Life Insurance is considered an intangible personal property for estate tax purposes.

This means that the proceeds are not subject to Federal taxes and can be used to pay off any estate taxes.

On the other hand, if the life insurance is on somebody else and the NRA owns it, that’s considered tangible property, so it will be subject to US estate taxes.

Qualified Terminable Interest Property Trust (QTIP)

This is another type of trust that allows married couples to utilize the marital deduction fully.

Essentially, the assets in the trust are not taxed at the first spouse’s death but are only taxable at the second spouse’s death.

The surviving spouse can enjoy the assets, but without control over them, as the grantor had already decided on who the beneficiary is.

These are great for second marriages where you want the spouse to, for example, enjoy being in a home, but have the home pass to kids from your first marriage.

QTIPS And Non-US Citizens

QTIPS only works if the surviving spouse is a US citizen. If they are green card holder or foreign nationals on a work visa, this will not work for them. But a QDOT may work.

Qualified Domestic Trust (QDOT)

A QDOT is similar to the QTIP, as it allows a non-US citizen spouse to claim the full marital deduction. Just like the QTIP, the assets must be held in the trust itself.

Typically, US citizen spouses can transfer an unlimited amount of assets to each other. However, if one of them is a non-US citizen, they can only receive up to $190,000 per year in 2025 from a US citizen.

If this spouse dies, and we do nothing, then the non-US citizen will have a huge tax bill, since they don’t qualify for the unlimited marital deduction. They may not be ready for that.

FAQs

At what net worth level do I need a trust?

There is an assumption that only wealthy people need trusts, but considering the flexibility and what you can gain from them, I believe there is no specific net worth requirement. One way to think about it is to consider the state you live in, the probate process, and the net worth required for the process. If you are above that number and have mitigated the impact of your immigration status, it may be worthwhile.

What else do I need to know about estate planning as a foreign national, particularly if I’m on a work visa?

Everybody needs an estate plan. You don’t have to be a millionaire to get one.

If you have children, it’s essential to have guardians appointed for them. Based on your state, you may be able to have overseas guardians. Read more about Overseas Guardians for Immigrants here.

Are You Worried About Making Mistakes With Your Estate Planning?

Why Professional Guidance Is Key

Estate planning is complex, especially when cross-border aspects are involved. You work so hard, but if you don’t manage this properly, a lot of your hard-earned wealth could potentially end up paying for estate taxes, instead of going to benefit your family.

But with proper planning, the estate taxes you could be liable for can be reduced dramatically. You can also specify precisely where you want your wealth to go and who should receive it when.

Looking to get your estate planning done, and done right? We partner with some of the best cross-border estate planners in the space to ensure your family is taken care of.

Free Financial Assessment

If you’re not ready to start, that’s okay. However, please stay up to date with our regular updates by email or by joining us here. Sign Up Here.

6 Things to Do

When Starting A Job on H-1B Visa

You are starting a new job on a work visa, there are some critical things, that will set up for financial success in the first 3-6 months. Download the free guide below for the detailed list!

We never spam. By signing up you’ll also receive access to future resources right to your inbox.

Disclaimer: This article is provided for general information and illustration purposes only. Nothing contained in the material constitutes tax advice, a recommendation for the purchase or sale of any security, investment advisory services, or legal advice. I encourage you to consult a financial planner, accountant, and/or legal counsel for advice specific to your situation. Reproduction of this material is prohibited without written permission from Jane Mepham and all rights are reserved. Read the full disclaimer here.