Being at the start of a marathon or any other long-distance race and then running it, is a great lesson in how to avoid investing mistakes.

A few weeks ago, I ran a very popular local marathon, the 3M Half-marathon.

The race provides pacer groups which are great for helping runners stay at a certain pace mile after mile. But you have to start with the group for it to be effective.

If your group is at the front, and you don’t get in place way before the race, it’s very difficult to get to your group, as you get closer to the start time.

Race Conditions

There was a lot of volatility at the start, so I wasn’t able to start with my pace group. I started at the back, and I had to weave in and out of groups of runners, going at a slower pace.

Easily avoided by getting into place early – think, avoid the investing mistake of waiting too long.

Then there is the agony or beauty of watching the elites disappear around the corner literally minutes after they start – there is a reason they let them go first!

If you start right after them, it’s very tempting to try and keep up with them even if it’s only for a couple of meters. This is a big mistake, that’s likely to cost you big on the other end.

Please, please don’t make this investing mistake by chasing the hot stocks – more on this later.

It was so cold that I started to wonder if I was truly going to be able to complete the race – not the kind of thoughts you want at the start of a 13.2-mile run.

These kinds of doubts combined with the start volatility are a good recipe for messing up what could be a great race.

Race Strategy

Not having a race strategy is a rookie mistake. You can tell who the pros are by their detailed strategies, as well as how much experience they are bringing to the race. They are a variation of the following:-

- Go easy at the start, then go hard at the end – a negative split

- Keep the same pace throughout running with a pace group. Otherwise really on your running watch, keeping track of the miles as you go along. This assumes you know the pace you want to run at.

- Just set the time you want to finish – for example, I want to be done in two hours. This is similar to the pace, but not as rigid. It’s a great strategy for those running a race for the first time.

- No strategy (a lot of people’s favorite) – just run and hope for the best etc – the focus is to simply finish.

- Walk the whole thing – as long as you are done, by the time they open the roads. Most races are pretty generous with walkers, so they give them plenty of time to walk the course.

My Race Strategy

My race strategy involves a series of well-executed steps – assuming I hit them all.

- Starting with the right pace group,

- Not being surprised by the starting volatility

- Getting my heart to slow down to race pace – very key for me.

- Reminding myself to be patient (out loud).

- Settling into my own pace.

- Being willing to make reasonable adjustments as I go along.

This is not my first race, so now I don’t panic when my heart starts racing and goes beyond what I expect during the race.

Or something else doesn’t work out at the start. I know I have 13.2 miles to rectify some of these mistakes.

The Results Of The Race

Knowing the above I didn’t panic about my pounding heart and the volatility. Instead, I left my gloves, my sweatshirt, and hat on to stay warm.

And then I forced myself to stay patient (very difficult), until around mile 3 (5k mark), when I had more room to pass slower runners (without having to run in the roadside ditches).

I finally settled into my race pace and from there, it was simply one foot in front of the other to the end. I didn’t make the podium (for my age group), but I’m very happy with the results.

Racing And Investing Mistakes

This story perfectly describes investing in the stock market. From here let’s discuss two broad investing mistakes and how to avoid them.

If you are looking at the short term, there is a lot of volatility in the market. The market goes up and down – the key is to be willing to ride it, and not try to deal with it at a micro level.

Making risky maneuvers can be devastating, as you try to smooth things out. Two examples: –

Stock Market Volatility And Investing Mistakes

Day Trading – An Investing Mistake For Majority.

One of the biggest concerns with day trading is loss even when it looks like you are winning. Up to 95% of day traders fail and lose money, according to some sources.

There are also some tax rules you need to keep in mind, otherwise, you end up like this day trader who was going to possibly pay an 800,000 tax bill from trading 45k on Robinhood.

Chasing The Latest Hot Stock

Hot stocks tend to drive news, and unfortunately, regular investors jump in when the stock is already up. There are a few cases of people making money, but very few people are willing to admit when they have lost money.

So, the stories you hear are of the lucky few who made money with the “hot” stock.

The best description that I have heard on this is “Trying to jump on a full train as it’s pulling out of the station.” Two things are likely to happen.

- You’ll get on, but likely end up with a lot of bruises – think emotional stress.

- You’ll likely going to fall off and get serious injuries – enough of that said.

A classic example of this is from the dot-com era when everybody was jumping into certain stocks mainly because of FOMO and unrealistic valuations which was a big investing mistake. When the bubble finally burst, millions of people lost a ton of money.

I was one of those people who jumped on a stock at the height with the wrong idea, and yes, I lost money.

Back to my race, a marathon cannot be rushed, unlike a sprint.

Don’t make the investing mistake of looking at things in the short term, instead, look at the whole picture, think long-term, zoom out, and things are going to likely to smooth out.

This translates to broad passive investments that take into consideration the whole market (domestic (US) and international (outside the US).

Taking such an approach means that you can confidently ride the ups and downs of the market – see this illustration – the market generally goes up, despite the volatility.

Historical Chart from Macrotrends.net

Have An Investing Strategy To Fix The Top Investing Mistake

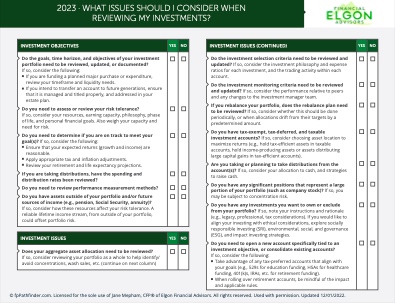

This is going to be one of the most important items as you embark on your investing journey. Decide when you are going to get in when your exit strategy is, and more importantly what that exit strategy is.

Ask yourself and answer honestly when do you need the money. Is this for a short-term or long-term goal?

Going back to the above, over long periods the market generally goes up, despite the daily/weekly ups and downs. Be patient and use diversification to lower the risks of losing money.

This nerd wallet article gives a list of 9 investing strategies, ranging from value investing to index investing to socially responsible investing. Which one sounds like your ideal?

Pick The Investing Vehicle To Fix No. 2 Investing Mistake

The choice of the investing vehicle is a critical part of your investing strategy. Making this investing mistake can cost you in different ways.

You want to have your money in three buckets at all times. This gives you flexibility now and in the future.

Taxable Account – This is your regular brokerage account, which can be opened just about anywhere. It’s the most flexible account when it comes to investing.

If you think you might be outside the US when you withdraw the money, use a firm like Charles Schwab or Interactive Brokers that is okay with having accounts with foreign addresses.

There are a few other firms as well that allow foreign addresses, but they won’t deal directly with you, you need to go through a wealth management firm.

Tax-deferred Accounts – These are your IRAs, 401ks, 403bs, 457(b) plans, etc. The money grows tax-deferred, but you pay taxes when you withdraw it. Only use these accounts, if you’re going to leave your money there for a long time.

Tax-free Accounts – This includes Roth Accounts, HSA’s, 401k Roth etc. These are great but not for everyone, based on what country you are likely to be in when you withdraw the money. This warrants a longer discussion on tax treaties.

The best part is, even though there may be others on the race with you, you can still run your race, be on your investing journey, and still come out a winner.

Keep it simple put on some blinders (leave it alone), and get on with your investing/running life.

Need Help With Your US Finances?

Check out our process that will help you evaluate our services, and let you make an informed decision about working together.

Get Started Now

If not ready to start, that’s okay, but please stay on top of our regular updates by email, or by joining here. Sign Up Here

Disclaimer: This article is provided for general information and illustration purposes only. Nothing contained in the material constitutes tax advice, a recommendation for the purchase or sale of any security, investment advisory services, or legal advice. I encourage you to consult a financial planner, accountant, and/or legal counsel for advice specific to your situation. Reproduction of this material is prohibited without written permission from Jane Mepham and all rights are reserved. Read the full disclaimer here.