With a month to go before the end of the year, I’m going to discuss the 2022 year-end financial checklist.

This is a list of financial issues, you should consider and act upon before year-end.

The list is geared towards saving you, what could potentially be thousands of dollars in taxes, at tax filing next year or in the future.

If you are a client of Elgon Financial Advisors, please reach out if you see opportunities here, we haven’t discussed in our meetings, or if you want to go deeper into the details.

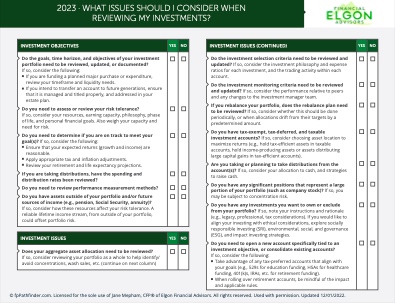

To make this easier, I’m sharing a PDF checklist that you can download that addresses the following areas and then some.

Asset & Debt Issues – Year-End Checklist

This addresses investment losses and being able to take advantage of them. It also addresses RMDs (Required Minimum Distributions), if you are at that age.

Tax Planning- Year-End Checklist

This is a biggie. Includes considering current and future income, business owners, and marital status change. It also addresses making the most of capital gains. In addition, it discusses how to think about different tax brackets.

Charitable Deductions and Taxes

If you are charitably inclined, you have an opportunity to do good, while saving taxes. The resource addresses a couple of strategies, you can use right away.

Bunching deductions to be able to go beyond the standard deductions

Tax-efficient funding strategies, like QCD (Qualified Charitable Deductions) (1)

Gifting appreciated securities

Donor-advised funds (2)

Cash Flow Issues & Saving

This portion is geared towards helping you save more in different accounts. If you are able to save more before the year is over, you have an opportunity to max out your retirement accounts and even do more if you are over 50 years old.

You can also do more with your 529’s going beyond the current $16,000 per beneficiary. This is a great strategy for grandparents looking to mitigate future estate tax issues.

Health Insurance

If you have a balance in your Flexible Spending Account, the resource addresses some options to consider before the end of the year, so you don’t lose the money.

Not included in the checklist is a store where you can spend some of the extra money if you still have a balance at the end of the year (3).

The Free Checklist Resource – Please Grab It!

What-Issues-Should-I-Consider-Before-The-End-Of-The-Year-2022[1]

Need Help Completing Your Year-End Financial Checklist?

Be proactive and work within the existing tax code to save yourself some money or do more to hasten your American Dream. Please click here if you’d like to set up a meeting and chat on the above topic or any other financial issues that affect your ability to pursue your American dream.

To stay on top of Elgon’s blog posts by email, please sign up here.

Sources

Disclaimer: This article is provided for general information and illustration purposes only. Nothing contained in the material constitutes tax advice, a recommendation for the purchase or sale of any security, investment advisory services, or legal advice. I encourage you to consult a financial planner, accountant, and/or legal counsel for advice specific to your situation. Reproduction of this material is prohibited without written permission from Jane Mepham and all rights are reserved. Read the full disclaimer here.