In today’s post, I’m going to answer the question “What financial planning strategies do you need if you are an immigrant (foreign-born) or a foreign national?”

If you are one of the 45 million foreign-born individuals now calling the US home, you have unique financial planning needs that go beyond what a traditional financial planner offers.

Just like US-born families, you are looking for a way to maximize your US financial resources in addition to your worldwide assets if any.

You most likely want a plan that considers your cultural background, as part of the financial planning for immigrants.

All the above leads to a need for unique financial planning strategies for immigrants and foreign nationals in the US.

Financial Planning Strategies For Immigrants That Address Your “WHY”

You moved to the US for a very specific personal reason. Over the years, I have come across a lot of different WHYs, a few of which I list below:

Further your education

Further your career

Build generational wealth and pass it on to your kids

Marry the love of your life!

An opportunity fell in your lap…

Add yours!

America is referred to as the “Land of Opportunity”. It’s one of the few countries where you can change your family’s trajectory in one generation.

You have an amazing opportunity to be able to pursue your WHY in the US. There is a reason America is referred to as the “Land of Opportunity”. It’s one of the few countries where you can change your family’s trajectory in one generation.

But there are technical issues that could derail the plan. So, you want financial planning strategies unique to your situation.

They should address different planning areas while keeping your WHY and your values front and center.

What Are The Financial Planning Strategies For Immigrants To Get You Started?

When you first arrive in the US, everything is new and alien. The financial terminology is different whether English is your home country’s spoken language or not.

This strategy needs to educate you about the US financial system and the terminology in use.

Everything you do should be looked at through the lens of your immigration status.

You want a financial planner who will simplify the complex and confusing environment you find yourself in.

Retirement is important, but other things are likely to take priority at the beginning and that’s okay.

You want to learn about taxation and how to file taxes when new, keeping in mind that you probably still have overseas assets which need to be reported.

You want to understand credit scoring and have a strategy to start building your US credit as a new immigrant as part of settling into the country.

What Strategy Will Allow You To Build And Maintain A Broad-Based Spending Plan?

You want your financial advisor to look at your planning issues through your cultural background lens, what’s important to you, and the overseas obligations you have.

In your spending plan, do you need to include supporting overseas families?

Do you have a 6-12 month emergency fund that caters to all your needs?

If there is a possibility of needing to make an emergency overseas trip, the fund should include return tickets for the whole family.

If on a work visa (H-1B, L-1, O-1, TN, or E-3, etc), a part of your budget should be allocated to legal and career development fees to keep your technical skills up to date. This is part of being prepared for a possible layoff on a work visa.

The legal bucket is important if you need to make quick visa changes.

Check out our growing resource, of financial planning articles for those on H-1B and other work visas.

Financial Planning Strategies For Immigrants Should Include Overseas Assets

As a newcomer to the US, one of the first things to do is to determine your tax residency status which is not the same as your immigration status.

Tax residency is based on something called the substantial presence test. This determines how you’ll be filing taxes.

The US is one of the few countries that will tax you on your worldwide assets. This means that once you become a US tax resident, your worldwide assets are now under the jurisdiction of the IRS.

It’s important to understand and have a strategy to deal with tax compliance issues, like the FBAR filing and FATCA filing requirements.

Not filing some of these forms can cost you a lot in penalties. If you become a citizen or a green card holder, and leave the country, you are still a US person for tax purposes.

In addition, you need a strategy to deal with the tax filing challenges of overseas investment assets, especially if an investment can be defined as a Passive Foreign Investment Company (PFIC).

There are other tax considerations with other assets based on the type of investment vehicle, ranging from businesses to corporations.

Foreign pensions are something to be approached cautiously. Most of the pensions are most likely going to be taxed by IRS.

Double taxation and sometimes punitive taxation are just some of the issues you want to be aware of and have strategies to deal with or minimize the financial effects.

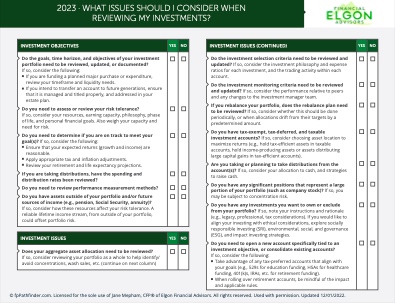

A Financial Planning Strategy To Invest In The US Stock Market

You can invest in just about every account, but you need a plan to figure out which accounts make sense in your specific situation.

Take advantage of workplace retirements, but understand that some tax-advantaged accounts, like Roth 401k(s), and HSAs can be an issue when withdrawn outside the US.

If you end up residing in a country without a tax treaty in place with the US, the tax-advantaged status of these accounts might not be recognized, leading to the accounts being treated as taxable accounts or foreign trusts.

If on a temporary immigrant visa like H-1B, L-1, etc., your financial advisor must stay up to date with all the issues that could impact you.

It should include a broad understanding of some of the nuances of the visas, like date of action, d/s, etc.

Other issues may arise when you want to save in the 529 plans, but the beneficiaries don’t have social security numbers. You need specific strategies that may go beyond the traditional accounts.

You still have the option of your kids attending overseas colleges, which is an advantage. Of course, you still want a strategy to pay for that.

Overall you want an Investment Policy Statement that includes your worldwide assets, for a comprehensive investing strategy.

Investement Management For Non-US Residents

Being a nonresident for tax purposes, should not stop you from investing here, but there are a few critical things to keep in mind.

Investement management for non-US residents, should be approached cautiouly with an eye on the type of account, long-term residency plans, and when you plan to take out the money. The accounts are taxed differently.

For example a brokerage account will have a 30% tax rate on dividends. There are a couple ways the taxes can be minimized.

Lowered by a tax treaty (between the resident’s home and the US)

Recovered via tax credits in the home country

If certain conditions are met, this account will be taxed differently, so it’s key to understand how this works. For example the US will not tax capital gains on the brokerage account if the following conditions are met:-

You are outside the US

Less than 183 days in the US

But keep in mind the home country may still want to tax you.

Planning Strategies To Deal With Estate Planning

You need an estate plan, that will include elements like a power of attorney assigned in case of incapacitation, or if unable to make decisions.

As a foreign-born parent or foreign national with no US family, a specific serious challenge is around guardianship. I get a lot of questions in this area.

You are probably wondering if you can name your sister who lives in another country as your kids’ guardian, hence the issue of international guardianship.

You name the guardian, but the court appoints them.

You need strategies that will ensure the court respects your wishes. Others include:-

Strategies to protect your present and future assets, and education as to how trusts work. A trust is not always the answer.

This needs to include strategies to deal with your overseas assets, whether you plan to move back to your home country or not.

If in a mixed marriage, and one or both of you are not US persons, you have unique challenges with estate and gift taxes. In 2023, the lifetime gift tax exemption is $12.06 million for a US person, which is plenty for the majority of people.

Non-US persons have an exemption of $60,000 only available for transfers at death, which means they are likely to pay federal taxes (at close to 40%), on everything else.

- If you are a US citizen married to a non-US citizen you can gift up to $175,000 tax free, hence the need for strategies for larger gifts.

Strategies To Deal with Domicile, Residence, and Gifting

You can be a US resident for income tax, but a nonresident for gift purposes, with different tax implications. This has to do with how IRS defines residency and domicile for gift and estate taxes.

This is a key concept when dealing with the tax implications of sending money overseas or estate taxes.

You want a very good understanding of the issues here, as well as how they apply to your situation.

Other Financial Planning Considerations For Immigrants

The above is a good start to financial planning areas you need to consider if you are foreign-born (immigrant) or a foreign national in the US. There are other things to address like insurance planning for immigrants, equity compensation (stock options) for foreign nationals, retirement strategies amongst others.

Based on your unique situation, the priority order is unique to you.

How Can We Help?

Elgon Financial Advisors is the company I started to help my fellow foreign-born (immigrants) and other foreign nationals pursue their version of the American dream.

I’m in the same situation as a lot of my clients. My immediate family’s roots are in two different continents, which means, my kids have 3 different countries they call “home”. I get it!

I developed a lot of my speciality initially to help my immediate and extended international family, but I now use it as the core base for my firm’s planning.

I have other members of my family hailing from other countries currently living in the US, I understand your situation.

I have a growing network of professionals who help me in these very specialized areas to serve you and to ensure all the above areas are fully addressed. You are in good hands.

Need Help Figuring Out The US Financial Landscape?

Schedule Your Free Financial Assessment

If not ready to start, that’s okay, but please stay on top of our regular updates by email, or by joining here. Sign Up Here.

Disclaimer: This article is provided for general information and illustration purposes only. Nothing contained in the material constitutes tax advice, a recommendation for the purchase or sale of any security, investment advisory services, or legal advice. I encourage you to consult a financial planner, accountant, and/or legal counsel for advice specific to your situation. Reproduction of this material is prohibited without written permission from Jane Mepham and all rights are reserved. Read the full disclaimer here.